Inside the Union Bank × Paytunes Audio Campaign: Building Awareness with Measurable Impact

Campaign overview/background

In January 2025, Union Bank partnered with Paytunes to launch a nationwide 60-day digital audio campaign promoting its Home Loan and Green Home propositions. The initiative featured 30-second audio creatives distributed across YouTube Audio, JioSaavn, Wynk, Pocket FM, Spotify Premium, Apple Podcasts, and Amazon Music. Designed to maximise reach within premium listening environments, the campaign reinforced brand trust while effectively driving qualified traffic to key product touchpoints.

Objectives

- Build broad national awareness while preserving efficient frequency in M/F 18–40.

- Maximise listening completion (LTR) as the core quality signal for message delivery.

- Improve CTR as a proxy for qualified interest, driving to Union Bank’s Home Loan and Green Home pages.

Strategy & execution

- Inventory mix: Dual-track distribution across YouTube audio and premium streaming/podcast inventory to blend scale with high-intent listening contexts.

- Creative alignment: Single-minded 30-sec assets mapped to Home Loan and Green Home CTAs, ensuring message continuity across environments.

- Pacing and caps: National flight with controlled frequency to stabilize reach and minimize fatigue, with daypart calibration as data emerged.

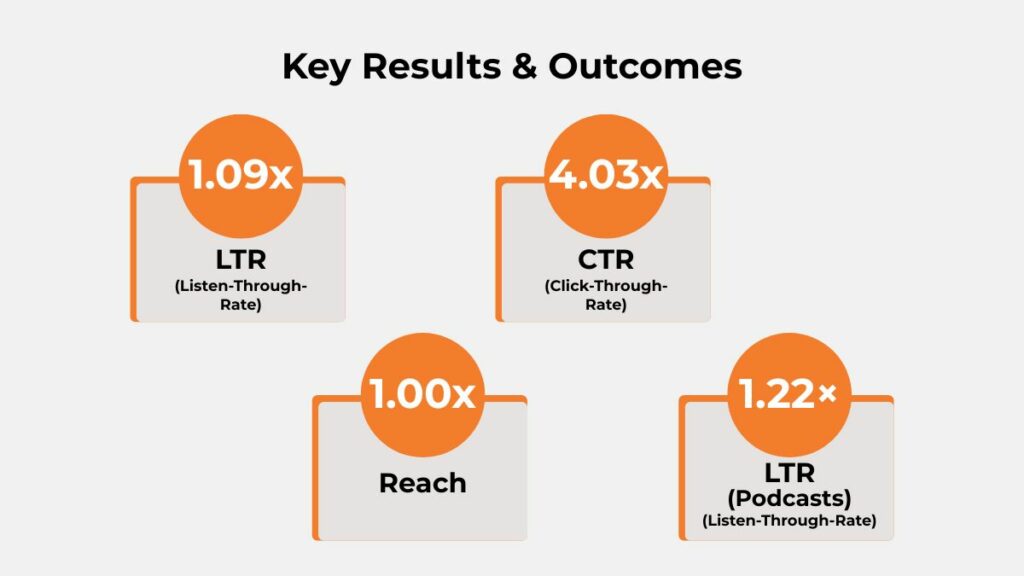

Key results & outcomes

- LTR improved to 1.09x and CTR to 4.03x versus baseline, while reach held at 1.00x, indicating significant quality and response lift at stable scale.

- For podcasts, the campaign delivered a 1.00× reach uplift and a 1.22× LTR uplift.

- Consistency: LTR maintained strong daily stability throughout most of the flight, reinforcing creative-audience fit across platforms.

- Incrementality: Multi-environment placement delivered a notable uplift in CTR without sacrificing listening quality, indicating complementary effects between YouTube audio and premium streaming/podcast supply.

Device-Type Insights

Mobile-first audience confirmed:

Over 98% of impressions came from mobile devices—primarily Android (87.74%) and iOS (10.92%).

Minimal desktop/tablet reach:

Less than 1% engagement from desktop, tablet, or smart devices—reaffirming the campaign’s mobile-first impact.

Optimized creative fit:

Strong LTR and CTR uplifts aligned with high mobile exposure, validating the audio + banner format for mobile-centric delivery.

Union Bank Ad Execution

Audience demographics & segmentation

- Core segment: M/F 18–40 pan-India, leveraging platform-level signals to maintain breadth and recency.

- Observation: Performance consistency across the core age band suggests the proposition resonated broadly, minimising the need for granular micro-segmentation in this phase.

Daypart/timing insights

- Day-of-week: Noticeable mid-week stability in LTR, coupled with CTR spikes around weekends, indicates that listener engagement remains consistent through the week while discovery and exploration behavior peak during leisure windows.

- Recommendation: Apply light budget multipliers to identified high-response dayparts while preserving baseline delivery for coverage.

Geographic/regional performance

- Scope: PAN India delivery across urban and semi-urban inventory.

- Note: With stable LTR nationwide, future phases can test tiered city weighting to identify incremental CTR pockets without compromising scale.

City-wise Segmentation

The campaign’s strongest Listen-Through Rates (LTRs) emerged from high-attention regional markets, reflecting strong resonance with localized audio and contextual relevance. Below is a city-wise breakdown of the top-performing regions:

- Mumbai (1.11x) – Delivered exceptional retention among metro audiences, proving premium placements can sustain attention at scale.

- New Delhi (1.08x) – Maintained stable LTRs across dense urban traffic, showing campaign efficiency in high-volume environments.

- Anantapur (1.14x) – Recorded the highest LTR, indicating deep engagement in smaller yet highly attentive markets.

- Sambalpur (1.13x) – Showcased strong listener focus, supported by well-aligned regional language and tone.

- Secunderabad (1.13x) – Maintained excellent completion rates across an urban audience with balanced reach and quality.

- Mangaluru (1.13x) – Demonstrated high message retention, driven by contextual alignment and regional familiarity.

- Khordha (1.12x) – Reflected consistent engagement within semi-urban clusters, highlighting effective audience targeting.

Next-highest performers included Guntur (1.12x) and Bhubaneswar (1.12x), both sustaining strong listener attention within the eastern and southern corridors.

Key learnings & takeaways

- Listening-first planning works: Prioritising LTR as the quality metric ensured the campaign protected message integrity while scaling nationally.

- Mixed audio supply is additive: The combined YouTube plus premium streaming and podcast mix delivered stable LTR alongside a complementary uplift in CTR, validating the effectiveness of a diversified audio stack.

- Timing matters: Weekend and select evening dayparts showed response advantages; structured pacing against these windows can compound results.

Challenges & how they were addressed

- Late-flight volatility: A few delivery dips and slightly lower LTRs were seen toward the end of the month. Adjusting line items and easing caps on steady placements helped smooth out these fluctuations.

- Inventory constraints: Where premium podcast supply tightened, shifting weight toward consistently performing audio channels preserved KPI momentum.

Recommendations for future campaigns

- Reinforce Paytunes KPIs: Maintain LTR optimisation as the primary quality bar, with CTR as the action signal; aim to sustain 1.09x LTR and 4.03x CTR or better through iterative creative testing and pacing.

- Structured dayparting: Allocate modest budget premiums to high-response periods (e.g., weekends/evenings) while retaining baseline coverage for reach continuity.

- Creative experimentation: Test shorter variants and alt-hooks to probe whether LTR stability can be maintained while further nudging CTR beyond the current multi-fold uplift.

- Geo layering: Use language-specific audio creatives and regional clustering to identify zones with higher CTR lift, while maintaining balanced coverage across all key markets.

- Safeguards: Add late-flight buffers and automated alerts to preempt end-of-month delivery volatility.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds, shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

In the Union Bank campaign, 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy. Here’s why it matters:

- The campaign achieved Listen-Through Rates (LTR) about 1.09x higher than industry benchmarks.

- This result means a substantial share of the audience listened all the way through, far higher than what visual formats deliver in the same time frame.

Listen to the Podcast Version of this Case Study

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.09x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Union Bank × Paytunes audio collaboration delivered quality at scale, achieving a 1.09x improvement in Listen-Through Rate (LTR) and a 4.03x uplift in Click-Through Rate (CTR), while maintaining reach at 1.00x. This proves that a well-balanced, diversified audio strategy can drive strong engagement without compromising the listener experience.

Discover how Paytunes can help your brand craft audio campaigns that connect, convert, and perform seamlessly.

Also Read – Case Study: How Alcon Boosted Engagement with Paytunes Audio Ads