How Timezone Used Digital Audio with Paytunes to Drive High LTR and CTR

Introduction

In September 2024, Timezone, one of India’s most popular family entertainment and gaming brands, partnered with Paytunes for a focused digital audio campaign designed to strengthen brand consideration and drive quality site visits.The campaign was structured as a 7-day initiative, giving a clear view of how Timezone benefits from immersive audio storytelling. With a strong presence across top Indian metros, Timezone needed a format that could hold attention, communicate excitement, and nudge audiences toward action—an ideal fit for digital audio.

Campaign Overview

The campaign ran with bilingual 30-second audio creatives in Hindi and English, paired with companion banners across premium music streaming platforms and 850+ apps. The objective was simple: reach a broad 18–44 audience, sustain strong LTR, and drive meaningful clicks from entertainment-seeking users across major metros.

Objectives

- Maximize unique reach among 18–44-year-olds while maintaining a strong Listen-Through Rate that reflects message clarity and audio quality.

- Ensure consistent delivery across priority metros while sustaining LTR at or above planned expectations.

- Drive high-intent site visits through companion banners, with CTR as the core indicator of efficiency.

Strategy & execution

Inventory Strategy

A balanced platform mix ensured both scale and quality:

- JioSaavn & Wynk Music – reliable scale and strong banner response

- YouTube Music – high completions contributing directly to LTR

- Pocket FM & Zeno Radio – incremental reach across niche listening environments

- Long-tail apps – broadened exposure across diverse urban audiences

Creative Approach

- 30-second bilingual audio ads

- Designed for leisure and entertainment moments

- Companion banners encouraged immediate site visits

- Messaging kept simple to maintain LTR and reduce drop-offs

Pacing & Optimizations

Daily monitoring of LTR, CTR, and audio delivery informed platform adjustments. More weight was shifted to high-performing platforms toward the later days, improving both completion strength and click response.

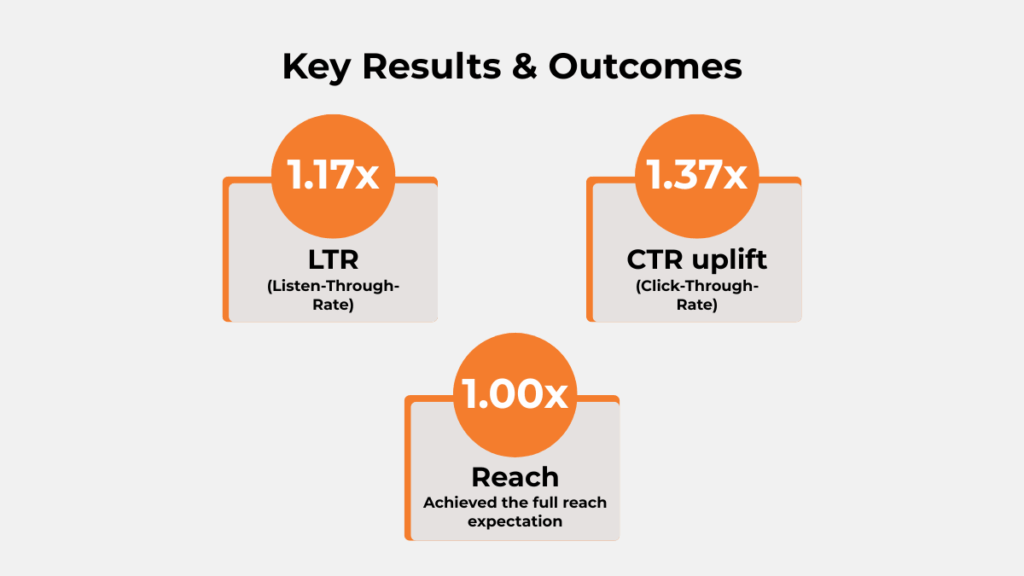

Key results & outcomes

LTR: Strong and consistent at 1.17×, indicating excellent message retention.

CTR: Delivered an uplift of 1.37×, driven mainly by mobile engagement and companion banners.

Reach: Achieved the full reach expectation at 1.00×, with broad distribution across metros.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Timezone Ad Execution

Audience demographics & segmentation

The campaign focused on male and female audiences aged 18–44 across Delhi NCR, Mumbai, Bengaluru, Hyderabad, Kolkata, Chennai, Pune, and Indore.

- Hindi + English ensured cultural relevance.

- English is skewed stronger in Mumbai and Bengaluru.

- Hindi contributed to high LTR and consistent CTR in North India.

Daypart/timing insights

Evening hours and mid-to-late campaign days saw higher CTR, as listeners engaged more deeply after cumulative exposure. Minor pacing variance was corrected with controlled adjustments the following days.

Geographic/regional performance

Delivery remained strong across metros:

- Delhi NCR and Mumbai drove scale

- Bengaluru, Hyderabad, Chennai, Pune, Kolkata, and Indore added incremental reach

- Bilingual creatives kept LTR high across regions and supported CTR in English-dominant markets

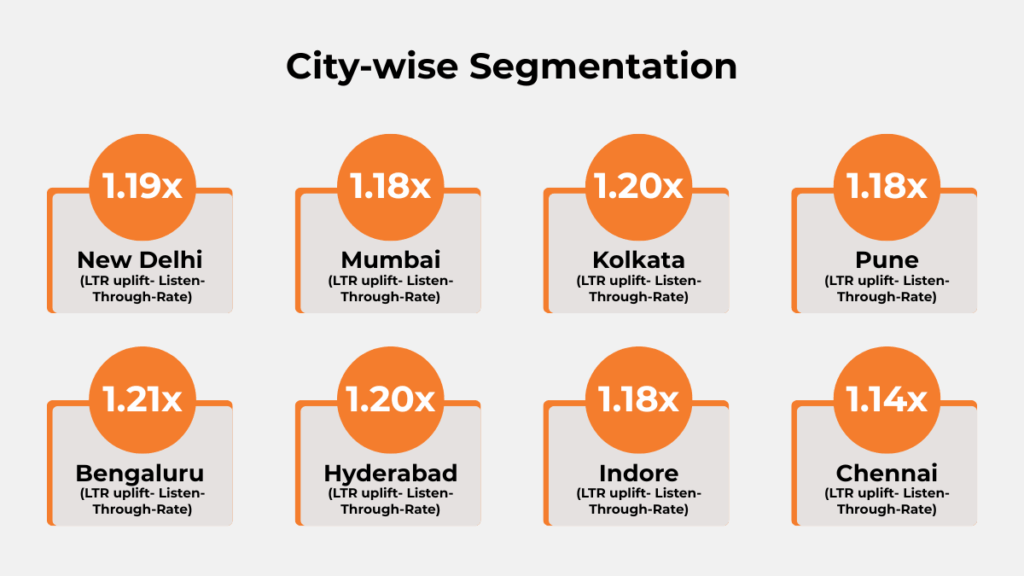

The campaign delivered strong Listen-Through Rate (LTR) performance across key urban markets. The following cities emerged as top contributors, each showing notable x-wise uplift in LTR, indicating higher-than-average audience attention and audio engagement.

City-wise Segmentation

- New Delhi (1.19× uplift): Consistent listener engagement reflects strong message resonance among the capital’s urban audience.

- Mumbai (1.18× uplift): High-intent, fast-paced listeners still showed sustained attention to the audio creative.

- Kolkata (1.20× uplift): Strong uplift highlights deeper content consumption and receptivity to audio storytelling.

- Pune (1.18× uplift): A digitally mature audience delivered steady listen-through behavior throughout the campaign.

- Bengaluru (1.21× uplift): The highest uplift among cities, signaling exceptional alignment between creative and audience mindset.

- Hyderabad (1.20× uplift): Robust LTR uplift indicates effective reach among a growing, tech-savvy listener base.

- Indore (1.18× uplift): Emerging city performance showcases increasing audio adoption and attentive listening patterns.

- Chennai (1.14× uplift): Solid uplift reflects consistent engagement in a traditionally strong regional audio market.

Key learnings & takeaways

- High LTR and strong CTR can coexist when audio placement aligns with natural listening behavior.

- Companion banners significantly lift click performance when paired with optimised audio distribution.

- Iterative adjustments across platforms directly contribute to CTR improvements without affecting LTR.

Challenges & how they were addressed

- Pacing Variance: Managed through reallocation and smarter caps to maintain consistent delivery.

- Uneven Banner Performance: Shifted impressions toward click-positive platforms without affecting completion rates.

Recommendations for future campaigns

- Use tighter day-level pacing controls for smoother delivery.

- Expand contextual targeting segments that historically drive higher CTR.

- Introduce small creative variations to test stronger hooks and enhance CTR uplift.

- Allocate incremental budgets to platforms with high completion strength while exploring mid-funnel engagement on Pocket FM and Zeno Radio

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Timezone campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.17x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.17x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Timezone Sep ’24 × Paytunes campaign delivered sustained LTR, strong reach, and consistent CTR growth. Thoughtful platform selection, bilingual creatives, and mobile-first execution ensured a well-balanced and effective audio strategy. With tighter pacing and expanded contextual tests in future campaigns, these results can scale even further.

Ready to unlock attention that actually converts?

Reach out to Paytunes to build your next high-impact audio strategy.

Also Read – KFC Audio Marketing Case Study With Paytunes