Shell × Paytunes Audio Campaign Case Study: Driving High LTR Across India

Campaign Overview & Background

In an increasingly distracted digital world, Shell aimed to reinforce its brand relevance among India’s growing base of automotive enthusiasts. Recognised globally for its innovation in fuels and lubricants, Shell partnered with Paytunes for a focused four-week digital audio campaign in August 2024. The initiative leveraged leading platforms such as JioSaavn, Wynk, and Pocket FM to reach a wide yet highly relevant listener base through short, impactful audio messages supported by companion banners. By combining strong audience intelligence with a mobile-first delivery strategy, the campaign successfully positioned Shell within everyday listening moments and strengthened its visibility among engaged, on-the-move consumers across the country.

Objectives

- Strengthen brand recall and affinity among automotive audiences.

- Achieve strong LTR by ensuring the audio creatives held listener attention until completion.

- Maximize campaign reach and encourage measurable consumer actions through CTR.

Strategy & Execution

- Platform Diversification: Ads were placed across JioSaavn, Wynk, and Pocket FM to ensure depth and breadth of delivery.

- Audience Targeting: Focus on 18–44-year-old male automotive enthusiasts, vehicle owners, and premium consumer segments.

- Creative Approach: A mix of Hindi and English audio assets were deployed to maintain clarity, attention, and completion.

- Measurement & Optimization: A live dashboard allowed daily tracking and timely adjustments to delivery and performance patterns.

Key Results & Outcomes

- LTR: Delivered a strong uplift of 1.21×, showcasing high message retention.

- CTR: Reached 0.80× of the benchmark, indicating a need for enhanced CTA and banner iterations.

- Reach: Maintained a 1.0× uplift, ensuring steady penetration across key markets.

- Consistency: Stable daily delivery with noticeable spikes in engagement during specific time windows.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Shell Ad Execution-

Audience Demographics & Segmentation

- Core audience: Males aged 18–44, vehicle owners, auto-interested, and digitally active.

- Strong resonance among listeners interested in automotive, tech, news, and sports content.

- High penetration across metros (Delhi NCR, Thane) as well as Tier 2/3 cities like Chandigarh and Lucknow.

Daypart/Timing Insights

- Engagement peaked during midweek and weekends, establishing optimal windows for future targeting.

- Consistent completion rates across the campaign reaffirmed the strength of the 30-second audio format.

Geographic/Regional Performance

Metro markets such as Delhi NCR delivered robust reach, demonstrating balanced impact across both urban and emerging regional audiences.

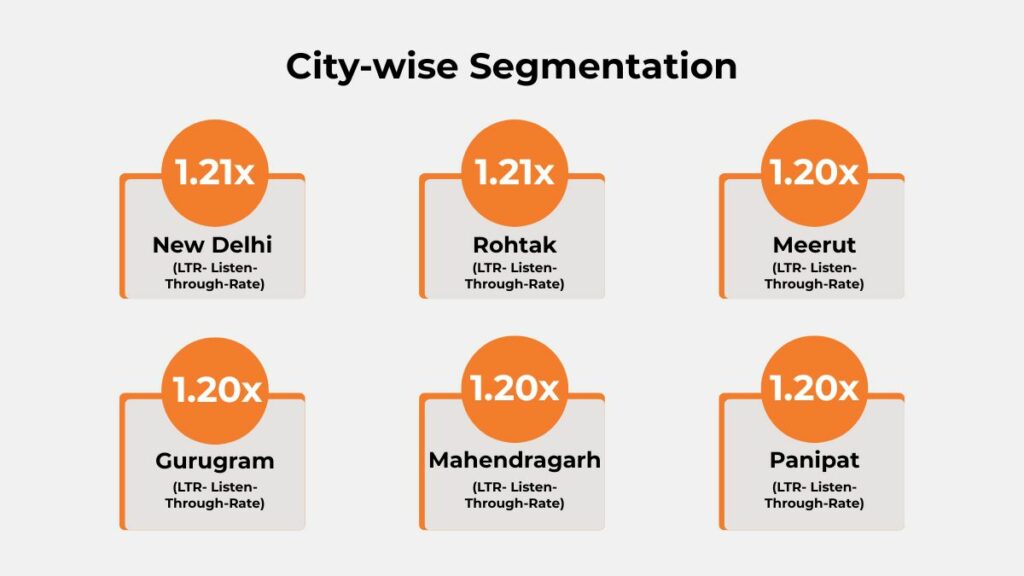

City-Wise Segmentation

Several northern Indian cities delivered exceptionally strong Listen-Through Rates, showing that audiences were highly attentive and engaged throughout the audio message. These regions demonstrated strong streaming behaviour, stable completion patterns, and a natural alignment with the campaign’s communication.

- New Delhi – 1.21×

A large and highly digital audience drove some of the strongest LTR levels in the campaign. - Rohtak – 1.21×

Consistent long-form listening habits helped sustain exceptionally high retention. - Meerut – 1.20×

Strong listener engagement contributed to stable and elevated LTR performance. - Gurugram – 1.20×

A digitally active, mobile-first population supported high completion rates. - Mahendragarh – 1.20×

Listeners maintained strong attention quality, boosting overall message retention. - Panipat – 1.20×

Demonstrated steady listen-through behaviour, making it a reliable attention market.

Key Learnings & Takeaways

- The high LTR confirms that Shell’s audio messaging strongly resonated with listeners.

- CTR performance suggests room for refined CTAs and better creative-banner alignment.

- Diversified platform delivery broadened reach, but optimized channel clustering can further strengthen action-oriented outcomes.

Challenges & Solutions

CTR Shortfall: Refined CTAs and updated companion banners were introduced mid-campaign to strengthen interaction.

Data Consistency: Continuous tracking ensured stable performance, allowing quick resolution of minor delivery variances.

Recommendations for Future Campaigns

- Experiment with alternate CTAs and banner formats to increase click behaviour.

- Leverage top-performing dayparts identified in this campaign.

- Maintain creative diversity with regional nuance and context-based messaging.

.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Shell campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.21x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.21x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements

Conclusion

The Shell–Paytunes August 2024 audio campaign demonstrated the undeniable strength of digital audio in sustaining attention, elevating brand recall, and effectively reaching mobile-first automotive audiences. With excellent LTR results and clear pathways for improving CTR, the campaign solidified audio’s position as a high-impact medium in today’s attention-challenged environment.

To explore how Paytunes can help your brand achieve similar high-attention results, get in touch with the Paytunes team today.

Also Read – Star Hospital Audio Campaign Case Study | Paytunes