KFC × Paytunes: Audio Campaign Case Study

Campaign overview/background

KFC, one of the world’s most iconic quick-service restaurant brands, partnered with Paytunes in October 2024 to execute a 20-day audio-first campaign aimed at boosting festive-season visibility in Kolkata. The initiative used 25–30 second in-stream audio ads paired with companion banners across top streaming platforms and curated gaming environments, ensuring strong reach and high-quality mobile-first engagement. Built around Paytunes’ core KPIs— LTR, CTR and reach, the campaign focused on delivering consistent listening experiences, maintaining controlled frequency, and encouraging action in high-attention moments.

Objectives

1. Strengthen LTR and Brand Recall

Reach 18–44 audiences across Kolkata and maintain high LTR as a key indicator of attention and message retention.

2. Improve CTR Efficiency

Identify publishers and dayparts where the combination of audio plus companion banners generated the highest likelihood of user action, without increasing frequency unnecessarily.

Strategy & execution

Channel Mix

The campaign ran across a wide selection of high-attention environments, including:

- Wynk

- JioSaavn

- Pocket FM

- Zeno

- Additional Paytunes DSP-integrated apps

- Select gaming titles to capture action-ready user segments

Creative Setup

A single, unified audio asset was used, accompanied by a companion banner optimized for mobile moments. Frequency controls ensured the message stayed impactful without causing fatigue.

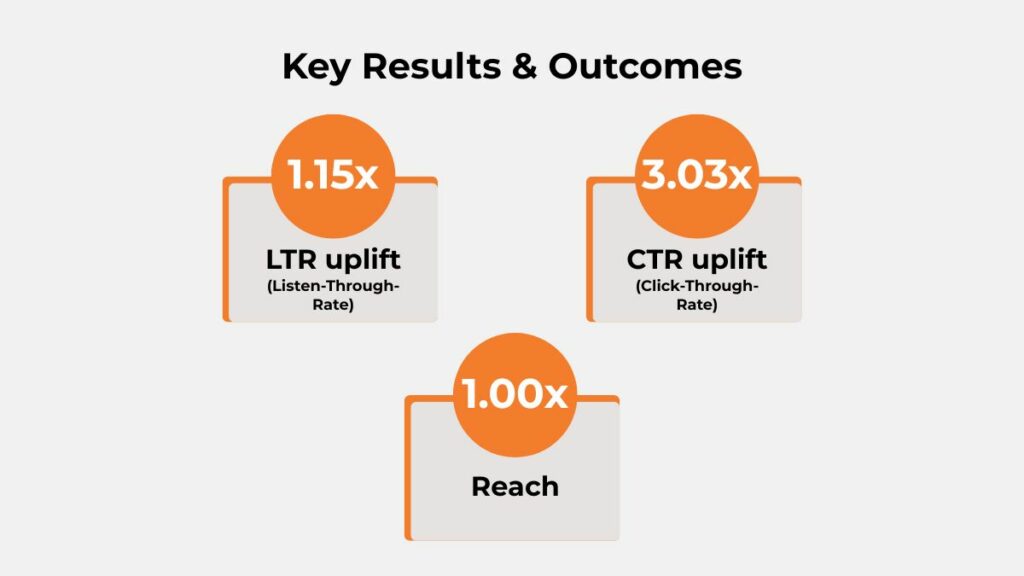

Key results & outcomes

Listen-Through Rate (LTR)

- 1.15× uplift

The campaign delivered stable, high-quality listening across the entire duration. Reach goals were slightly over-delivered, ensuring minimal waste and improved unique exposure volumes.

Click-Through Rate (CTR)

- 3.03× uplift

CTR performance improved significantly on strong publisher days, driven especially by gaming inventory and high-attention music platforms.

Reach

- Overall reach matched the planned scale at 1.00×, delivering with minimal waste and generating a measurable uplift in total unique exposures compared to the initial projections.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.94% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

KFC Ad Execution

Audience demographics & segmentation

Core audience: 18–44, mixed gender, heavily mobile-first.

Broad entertainment and lifestyle contexts helped sustain high LTR and unlocked CTR surges among gaming cohorts more responsive to banners.

Companion banners supported recall and increased click propensity where users were already actively engaged on their smartphone

Daypart/timing insights

- Early to mid-period days showed more stable LTR.

- CTR saw weekday spikes, indicating that commute hours and evening listening moments were most action-driven.

- Controlled pacing across days protected listening quality while minimizing unnecessary frequency surges.

Geographic/regional performance

The campaign was executed exclusively in Kolkata, delivering consistent performance across the duration. While sub-regional insights were limited due to available logs, future campaigns can enhance hyperlocal learnings by adding more detailed geo-level data capture.

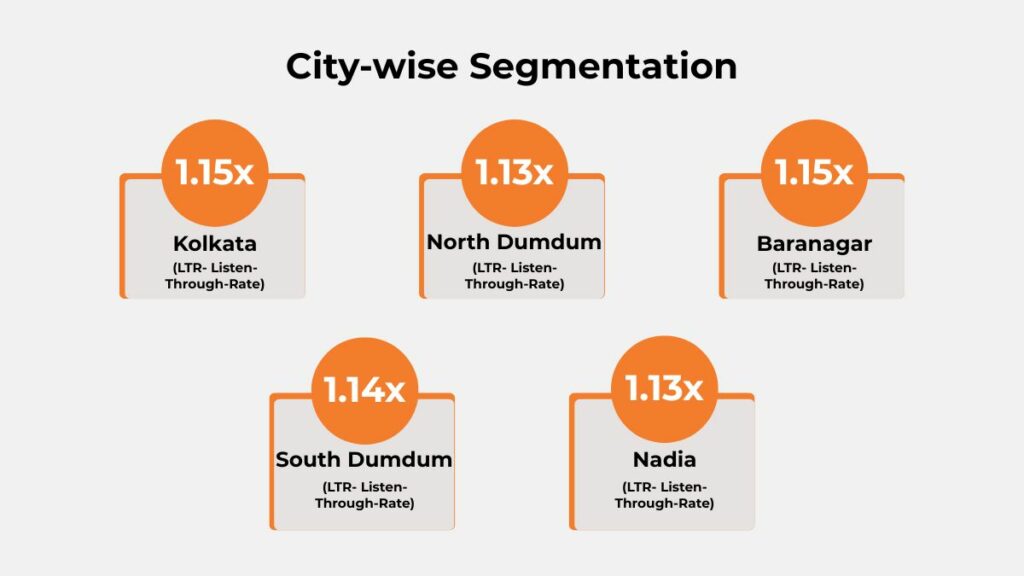

City-Wise LTR Segmentation

To understand how listeners across different parts of Kolkata responded to the audio campaign, LTR performance was mapped region by region. The results show consistently strong listening behavior across both central and peripheral zones, indicating that the creative and placement mix resonated well with diverse audience clusters.

- Kolkata: Delivered a strong LTR of 1.15×, indicating consistent listener engagement across core urban areas.

- North Dumdum: Achieved an LTR of 1.13×, reflecting steady attention levels within dense residential zones.

- Baranagar: Recorded an LTR of 1.15×, matching central Kolkata’s high completion performance.

- South Dumdum: Reached an LTR of 1.14×, supported by healthy in-stream listening behavior.

- Nadia: Secured an LTR of 1.13×, showing stable engagement even among outer-region audiences.

Key learnings & takeaways

Audio Attention Is Exceptionally Resilient

LTR stayed strong across platforms, showing that well-crafted audio creative fits naturally into in-stream environments. CTR varied more by context, highlighting the need for tailored testing by platform and app category.

Diverse Inventory Reduces Duplication Risk

A multi-platform mix supported efficient reach at controlled frequency. Standardized publisher naming and structured data fields will accelerate deeper insights going forward.

Challenges & how they were addressed

Data & Reporting Consistency

Inconsistent naming conventions, incomplete logs, or mismatched reporting formats made it harder to consolidate performance and derive clean insights. Standardized templates and routine QA checks can reduce this friction in future campaigns.

Inventory & Delivery Balance

Some platforms delivered faster or slower than expected, requiring manual adjustments to maintain even pacing. More granular caps and automated pacing alerts would help streamline delivery control.

Recommendations for future campaigns

Publisher-Specific Creative Variants

Introduce small creative variations tailored to different platforms—such as customized openings, context-aware messaging, or platform-specific CTAs. This helps convert strong listening performance into higher engagement by aligning the message with how users naturally consume content on each app.

Micro-Daypart A/B Testing

Test different time windows, such as morning commutes versus early-evening relaxation periods, to identify when users are more receptive to taking action. Fine-tuning delivery by daypart can strengthen CTR without compromising listening quality.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the KFC campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.15x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.15x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The October 2024 KFC × Paytunes 30-day audio campaign showcased how a well-designed audio strategy can deliver both sustained attention (LTR) and efficient action (CTR) in a mobile-first environment. Consistent listening quality, diversified placements, and smart pacing allowed the campaign to exceed performance expectations while reinforcing the brand’s festive-season visibility.

For brands aiming to replicate these outcomes, audio offers a rare combination of attention resilience and action potential—especially when powered by Paytunes’ data-led planning.

Want similar results?

Request a custom Paytunes plan audit and performance forecast for your brand today.

Also Read – Honda Audio Marketing Case Study Powered by Paytunes