Honda × Paytunes: Audio Campaign Case Study

Campaign Overview

Honda, one of India’s most trusted automotive brands, partnered with Paytunes in October 2024 for a 30-day audio-first campaign aimed at capturing attention in a cluttered digital landscape. Known for reliability and innovation, Honda sought meaningful communication that reached adult audiences across priority states. The campaign used 25–30 second audio spots paired with companion banners across premium music apps, podcasts, YouTube Music, and 850+ in-app audio surfaces. Its focus was to strengthen Listen-Through Rate, drive quality traffic through CTR, and maintain steady reach, creating a balanced strategy that delivered uninterrupted listening and consistent engagement across mobile-first environments.

Objectives

- Expand reach among adults aged 30+ across target states.

- Maintain strong completion using LTR as the primary attention metric.

- Drive quality traffic through CTR from companion banners.

- Use pacing and daypart optimization to stabilize LTR and improve CTR over the month.

Strategy & Execution

- Multi-platform distribution

The campaign ran across YouTube/YouTube Music, JioSaavn, Wynk, Pocket FM, and more than 800 in-app audio apps to maximize reach and minimize duplication. - Creative pairing

Every 25–30 second audio spot was paired with a static companion banner. This reinforced messaging and provided an instant click path for high-intent users. - Daily monitoring and optimization

Ongoing monitoring allowed the team to shift delivery into higher-yield time periods and placements, while keeping LTR stable and improving CTR towards the end of the campaign.

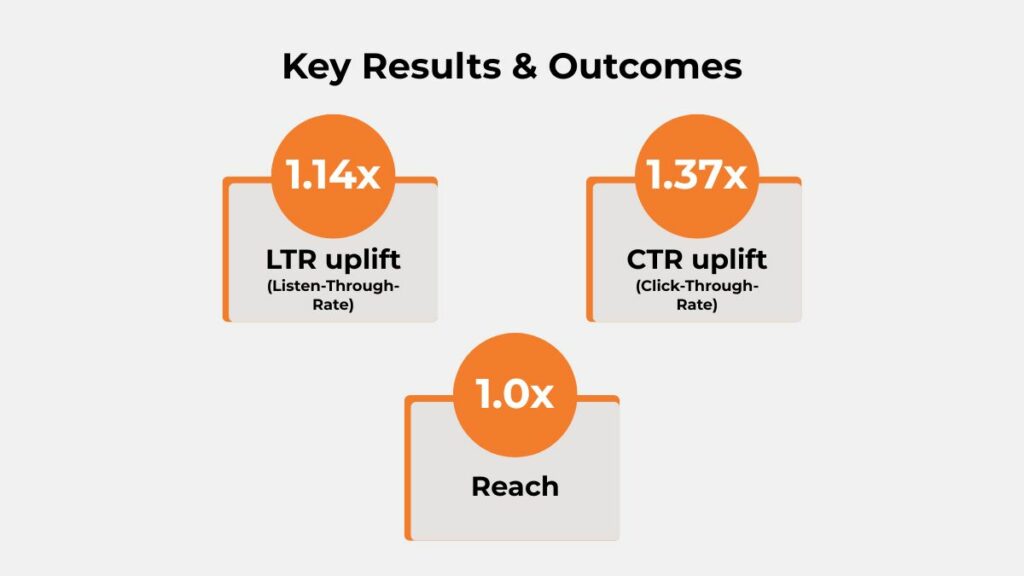

Key Results

Listen-Through Rate (LTR)

- Achieved approximately 1.14x uplift, matching premium benchmarks for 25–30 second audio.

Click-Through Rate (CTR)

- Delivered around 1.37x uplift, with clear improvement in the second half of the campaign as optimizations accumulated.

Reach

- Expanded reach by approximately 1.0x, supported by strong platform diversity and pacing.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Alukka Gold Ad Execution

Audience demographics & segmentation

- Adult audiences: Focused on 30+ male/female cohorts across multiple states to align with product positioning and scale goals.

- There is an opportunity to add more detailed audience groups in future campaigns. By testing segments such as device types, interests, and age groups, Honda can identify which audiences respond best and then focus more spend on those high-performing segments.

Daypart/timing insights

- LTR remained steady throughout the month.

- CTR increased in the mid-to-late period after effective placement and timing adjustments.

- Late-month performance showed strong action windows that can be used as templates for upcoming campaigns.

Geographic/regional performance

- Broad coverage: Priority markets spanned more than 10 states; the plan design supports efficient reach and context diversity.

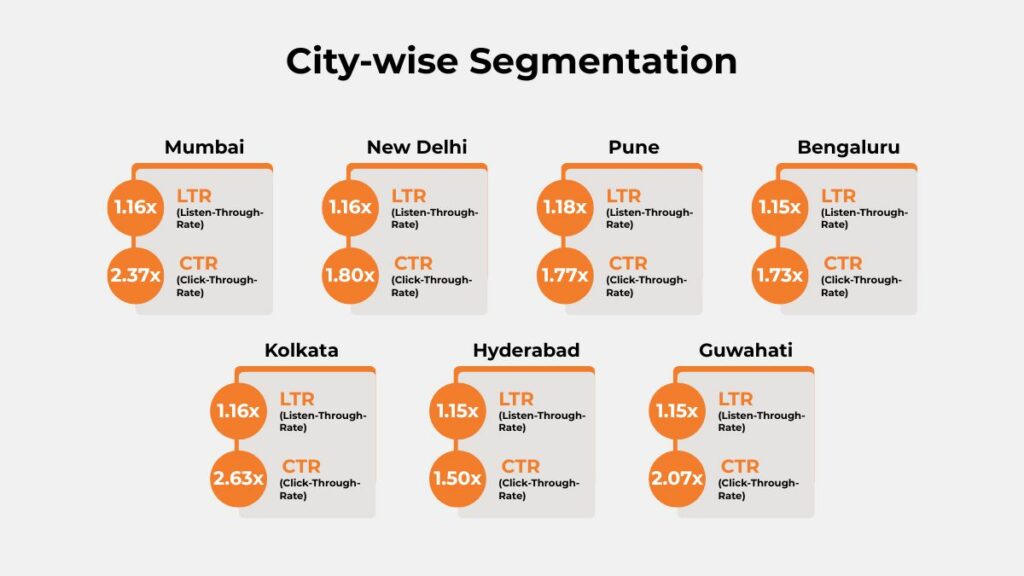

Citywise Segmentation

The campaign delivered strong and consistent results across major Indian cities, with each market contributing uniquely to overall performance. By reviewing LTR and CTR together, we can clearly see how different regions responded to the audio creatives and companion banners, offering useful direction for future targeting and scale.

- Mumbai: Delivered a strong 1.16× LTR uplift and an impressive 2.37× CTR uplift.

- New Delhi: Achieved a steady 1.16× LTR uplift along with a solid 1.80× CTR uplift.

- Pune: Recorded one of the highest 1.18× LTR uplifts and a strong 1.77× CTR uplift.

- Bengaluru: Reached a reliable 1.15× LTR uplift and maintained a healthy 1.73× CTR uplift.

- Kolkata: Delivered a solid 1.16× LTR uplift and the highest 2.63× CTR uplift across cities.

- Hyderabad: Achieved a consistent 1.15× LTR uplift with a moderate 1.50× CTR uplift.

- Guwahati: Showed a stable 1.15× LTR uplift paired with a strong 2.07× CTR uplift.

Key learnings & takeaways

- Audio maintains attention: 25–30 second audio spots delivered stronger sustained attention than most mobile visual formats.

- Optimization multiplies results: Consistent tuning maintains LTR quality while allowing CTR to rise.

- Mobile-first strategy works: The highest engagement came from Android and iOS, reinforcing the relevance of mobile audio environments.

Challenges & how they were addressed

- Reporting variation: Differences in platform labels and fields made comparison difficult. A standardized reporting structure will streamline future insights.

- Limited segmentation: Lack of detailed cohort splits restricted deeper optimization. Daypart and publisher-level adjustments helped preserve KPIs.

Recommendations for future campaigns

- Iterate Creative Variants: Use A/B testing for audio scripts and companion banners to understand which message styles and tones drive stronger LTR and CTR.

- Adopt Consistent Monitoring Cycles: Review performance daily or mid-week to make timely adjustments in placements, pacing, and targeting for compounding gains over the campaign period.

- Strengthen Reporting Frameworks: Create standardized reporting dashboards with consistent fields for platforms, regions, devices, and cohorts to enable faster comparisons and clearer insights.

- Use Data-Driven Guardrails: Set baseline performance thresholds—such as minimum LTR levels—and optimize pacing and bids to improve CTR and other action metrics without compromising completion quality.

- Expand Audience Segmentation: Test interest groups, device tiers, age bands, and geo-specific cohorts to identify high-performing segments that can deliver stronger KPI uplifts.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Honda campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.14x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.14x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

Honda’s October 2024 campaign with Paytunes demonstrates how a smart, mobile-first audio approach can deliver sustained attention and meaningful action at scale. Over 30 days, the campaign recorded an impressive 1.14x uplift in LTR, a ~1.37x rise in CTR, and a ~1.0x expansion in reach, showcasing the power of diversified audio delivery and consistent optimization.

To achieve similar results for your brand, connect with Paytunes for a tailored audio plan or a quick strategy demo.

Also Read – Alukka Gold × Paytunes: High-Performance Audio Campaign Case Study