How Cetaphil BHR Cleanser Drove Beauty Discovery and Engagement Through Digital Audio Advertising

Campaign Overview

Cetaphil is a globally trusted skincare brand known for gentle, dermatologist-recommended formulations designed for sensitive skin. In May 2024, Cetaphil partnered with Paytunes to amplify awareness for its BHR Cleanser through a focused 46-day digital audio campaign. The initiative reached beauty-conscious women aged 20–35 across premium music streaming environments, combining immersive audio creatives with companion display banners to guide users seamlessly to Nykaa product pages. The campaign used programmatic delivery to ensure relevance, scale, and consistent engagement throughout the entire duration.

Objectives

- Build strong brand awareness for Cetaphil BHR Cleanser among young female beauty enthusiasts.

- Deliver meaningful reach while encouraging deeper audio engagement and click actions.

- Evaluate campaign effectiveness using Listen-Through Rate first, followed by Click-Through Rate.

Strategy & Execution

- Targeted females aged 20–35 with a strong interest in beauty and skincare content.

- Activated premium music platforms including Wynk, JioSaavn, and YouTube Music.

- Used a CPM buying model to ensure efficient reach across a large audio ecosystem.

- Paired audio creatives with display banners linked directly to Nykaa landing pages.

- Optimised delivery daily based on engagement signals and audio performance trends.

Key Results & Outcomes

- Achieved a 1.13× uplift in Listen-Through Rate, indicating strong audio attention and message retention.

- Delivered a 1.3× uplift in Click-Through Rate, reflecting improved user responsiveness.

- Maintained steady reach of 1.00x across the 46-day period with consistent engagement growth.

- Reinforced the effectiveness of digital audio for skincare discovery in a competitive category.

Audience Demographics & Segmentation

- Primary audience consisted of females aged 20–35 with a strong inclination towards beauty content.

- Engagement was evenly distributed across the 18–24 and 25–34 age groups.

- Average Listen-Through Rate remained stable at around 0.89 across audience segments, confirming message relevance.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Cetaphil Ad Execution –

Daypart & Timing Insights

- Higher Click-Through activity was observed during weekends compared to weekday averages.

- Listen-Through Rate stayed consistently strong, especially during evening listening hours.

- Campaign momentum built steadily after the first week and remained stable through the later phases.

Geographic & Regional Performance

- Metro cities such as Mumbai, Delhi, and Kolkata led overall delivery and engagement.

- Mumbai and Delhi showed strong Listen-Through consistency alongside high interaction levels.

- Emerging cities like Coimbatore and Surat recorded higher relative Click-Through performance, highlighting untapped potential beyond metros.

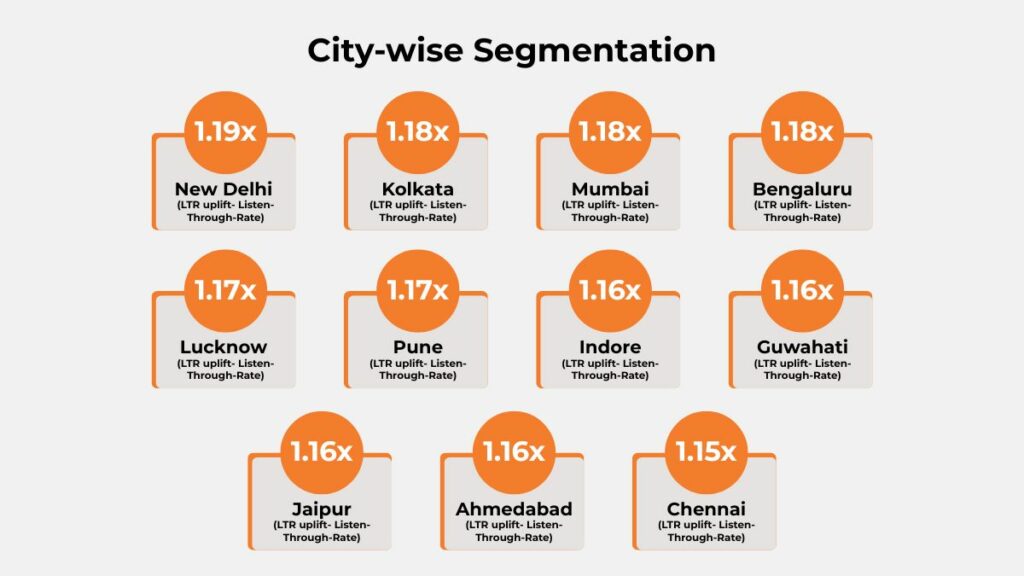

City-wise Segmentation

The following cities delivered the strongest Listen-Through Rate (LTR) performance in the campaign, measured as ×-wise uplift against a baseline LTR of 80%. Each city listed below exceeded the benchmark, highlighting higher audio attention and sustained listener engagement across key markets.

- New Delhi (1.19× uplift): New Delhi recorded the highest LTR uplift, reflecting strong listener focus and consistent message retention throughout the campaign.

- Kolkata (1.18× uplift): Kolkata showed high audio engagement, with listeners staying attentive well beyond the baseline benchmark.

- Mumbai (1.18× uplift): Mumbai delivered stable and above-average LTR, reinforcing its role as a high-attention metro market.

- Bengaluru (1.18× uplift): Bengaluru demonstrated strong listening behaviour, indicating high relevance of the audio message among urban audiences.

- Lucknow (1.17× uplift): Lucknow emerged as a strong performer, with LTR levels indicating growing receptiveness in non-metro markets.

- Pune (1.17× uplift): Pune maintained steady listener attention, contributing consistent uplift against the baseline LTR.

- Indore (1.16× uplift): Indore delivered reliable LTR performance, signalling effective engagement in a tier-2 city environment.

- Guwahati (1.16× uplift): Guwahati showed encouraging audio engagement, highlighting regional scalability beyond traditional metros.

- Jaipur (1.16× uplift): Jaipur achieved solid LTR uplift, confirming strong listener interest across the campaign period.

- Ahmedabad (1.16× uplift): Ahmedabad sustained healthy audio attention, performing well above the baseline benchmark.

- Chennai (1.15× uplift): Chennai delivered consistent listening levels, rounding off the list with steady engagement and message completion.

Key Learnings & Takeaways

- Digital audio is highly effective for engaging female beauty audiences at scale.

- Platform selection plays a critical role in driving stronger engagement outcomes.

- Weekend listening behaviour significantly enhances interaction rates.

Challenges & How They Were Addressed

- Minor data inconsistencies from platform syncing were identified early through daily monitoring.

- Delivery was optimised by prioritising cities and platforms with stronger Listen-Through performance.

- Underperforming publishers were deprioritised in favour of consistently reliable audio platforms.

Recommendations for Future Campaigns

- Expand focus on high-performing tier-2 cities to unlock incremental efficiency gains.

- Increase weekend exposure to sustain stronger interaction levels.

- Allocate budgets more aggressively towards top-performing platforms.

- Explore combined audio and visual formats to deepen engagement further.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Cetaphil BHR Cleanser campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.13x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.13x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements

Conclusion

The Cetaphil BHR Cleanser campaign demonstrated how digital audio, when executed with precision, can drive meaningful attention and action for skincare brands. Through Paytunes’ programmatic expertise and premium audio reach, the campaign delivered strong Listen-Through and Click-Through uplifts while maintaining efficiency over a long duration.

Ready to make your brand heard where it truly matters? Partner with Paytunes and turn attention into impact.

Also Read – Thalapakkatti Biryani Audio Ads Case Study: Driving Restaurant Buzz in Bangalore with Paytunes

If you want to advertise on Spotify, Visit this page – Spotify Advertising