Campaign Overview / Background

Miniklub’s Audio Campaign, launched by the premium kidswear brand in partnership with PayTunes, activated a 21-day audio-first initiative targeting urban mothers in Bengaluru. The goal was to amplify engagement during a key sale window using immersive, high-attention digital audio inventory across leading streaming platforms.

As part of this collaboration, PayTunes’ proprietary audio ecosystem—which prioritizes Listen-Through Rate (LTR), Click-Through Rate (CTR), and Reach as primary engagement KPIs—was leveraged to deliver precision-targeted audio experiences.

Objectives

- Drive high-engagement reach among urban women via audio.

- Improve brand recall and store interest during the sale period.

- Utilize PayTunes’ high-LTR inventory to ensure message retention.

Strategy & Execution

Platform Mix: Wynk, JioSaavn, PocketFM, Triton, AdsWizz

Media Type: 30-sec audio + companion banners

Buy Model: CPM with frequency capping

Target Group: Female, aged 25–40, on premium smartphones

Geo Targeting: Bengaluru

Creative Deployment: Static audio messaging with a focus on time-optimized delivery (evening slots)

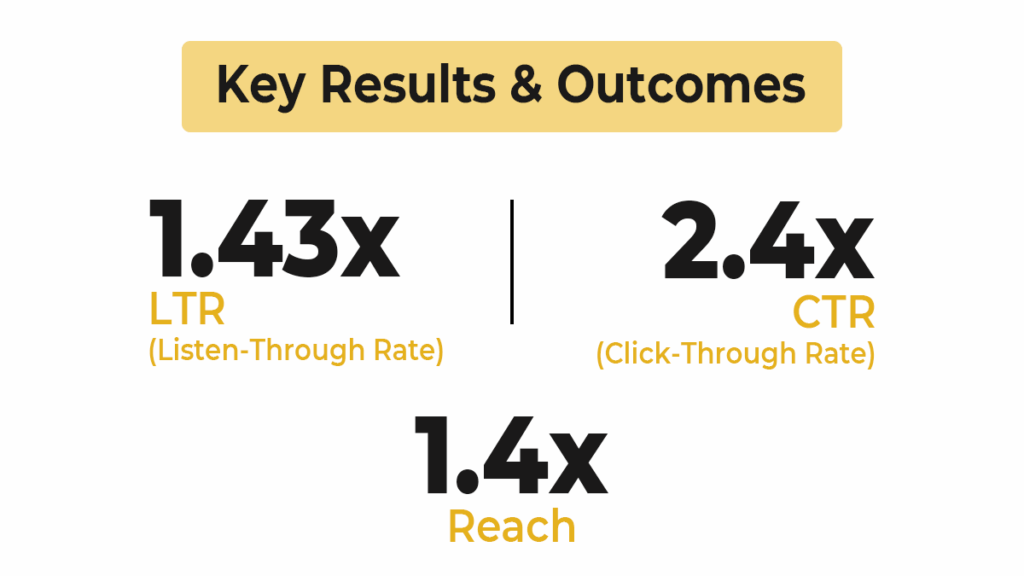

Key Results & Outcomes

LTR: Achieved an average Listen-Through Rate of 1.43x uplift over standard digital audio benchmarks.

CTR: Delivered up to 2.4x uplift over planned expectations

Reach: Surpassed internal unique user projections by 1.4x—demonstrating high efficiency in exposure and targeting.

Audience Demographics & Segmentation

Gender: Female (100%)

Age Group:

25–34: Drove consistent engagement with up to 2x uplift in LTR.

35–40: Slightly higher performance, with LTR and CTR uplift nearing 2.5x–3x.

Note: Campaign targeting was capped at 25–40, while reporting included up to 44 for performance analysis.

Device-Type Insights

- Mobile-first audience confirmed:

Over 98% of impressions came from mobile devices—primarily Android (87.74%) and iOS (10.92%).

- Minimal desktop/tablet reach:

Less than 1% engagement from desktop, tablet, or smart devices—reaffirming the campaign’s mobile-first impact.

- Optimized creative fit:

Strong LTR and CTR uplifts aligned with high mobile exposure, validating the audio + banner format for mobile-centric delivery.

Daypart/Timing Insights

- Highest LTR and CTR observed during post-8:30 PM delivery windows.

- Evening audio correlated with 3x+ LTR uplift, indicating high ad completion during leisure time.

Geographic Performance

- Hyperlocal targeting within Bengaluru led to strong market penetration.

- Campaign delivery achieved 1.4x uplift in unique user reach vs. internal projections.

Key Learnings & Takeaways

Audio as a Core Channel: Proved effective in driving both attention and action.

Platform Synergy: PocketFM and JioSaavn were key drivers of engagement uplift.

Demographic Insight: Older millennial moms (35–40) responded especially well—offering cues for refined segmentation.

Recommendations for Future Campaigns

Align Targeting & Reporting: Ensure demographic targeting maps directly to analysis buckets.

Leverage High-LTR Time Slots: Prioritize evening delivery to boost engagement.

Creative Refresh Mid-Campaign: Rotate audio creatives every 7–10 days.

Introduce Attribution Mechanisms: Use dynamic links or third-party trackers for post-click analysis.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average attention span has dropped to ~8 seconds. Brands must grab—and sustain—attention long enough to make real impact.

The Problem: Fleeting Attention on Most Digital Platforms

Banner/display ads typically command only 1.6–2.6 seconds of attention.

Short-form videos and reels hold attention for 7–9 seconds before users swipe or skip.

Result: Weak recall and low post-exposure action.

The Unique Edge of In-Stream Digital Audio

Miniklub’s campaign exclusively used 30-second digital audio ads, served across high-engagement platforms with companion banners—delivered in screen-free, multitasking-friendly environments.

LTR: Achieved up to 4x uplift on peak days, translating to 1.43x above industry norms.

CTR: Surpassed expectations with a 2.4x uplift, reflecting not just passive listening, but clear action intent.

Audience: Urban mothers in the 25–40 age group consistently engaged, validating the audio-first approach.

Miniklub’s Audio Campaign Ad Execution –

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (sec) | Completion Rate (per 100) | Audio Attention Uplift |

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 3–8x higher (Miniklub campaign) |

- Banner ads aren’t retained long enough to build brand memory.

- Short-form videos, though better, are still swipe-prone.

- But 30s audio commands undistracted, hands-free attention—perfect for recall and action.

With 3–8x higher completion rates, Miniklub’s audio-first approach didn’t just compete—it owned the moment.

Let PayTunes Power Your Next Big Win

From retail and FMCG to tech and lifestyle, PayTunes helps brands break through the noise with audio-led strategies that spark action. Ready to turn attention into outcomes?

Partner with PayTunes and launch your next high-performance audio campaign today.