Campaign Overview

In a highly cluttered fintech market, StockGro partnered with PayTunes to launch a 10-day audio advertising campaign aimed at urban millennials and Gen Z investors. The campaign strategically targeted Bangalore and Pune, India’s leading tech hubs, using 30-second audio ads supported by dynamic companion banners across popular music streaming platforms.

This innovative approach combined auditory impact with visual cues, delivering StockGro’s message in a format suited to the listening habits of its core demographic.More importantly, PayTunes measured success through real listener engagement metrics—Listen-Through Rate (LTR), Click-Through Rate (CTR), and Reach uplift, offering deeper insight than traditional impressions.

Objectives of the Campaign

- Boost Brand Recall: Reinforce StockGro’s positioning as a trusted platform for learning and trading.

- Drive Action via Companion Banners: Encourage real interactions like app downloads and sign-ups.

- Maximize Resonance Using Frequency Caps: Optimize message retention by limiting ad exposure per user.

- Ensure High Engagement by Timing Deliveries: Focus on peak listening windows based on LTR trends.

Campaign Strategy and Execution

Platform Strategy

The campaign was deployed across:

- Wynk

- JioSaavn

- Pocket FM

- Zeno

Wynk and JioSaavn drove the majority of delivery, helping achieve scale, while Pocket FM and Zeno added audience diversity.

Creative Approach

All creatives were 30-second audio spots, complemented by visually rich, clickable banners. The messaging focused on investment education, stock trading ease, and the StockGro app advantage.

Geo-Targeting

Only two cities—Bangalore and Pune—were targeted to concentrate delivery among the most relevant user base: young, financially literate urbanites.

Frequency Capping

Exposure was tightly controlled to ensure sustained listener attention without over-saturation—contributing directly to consistent LTR uplift throughout the campaign.

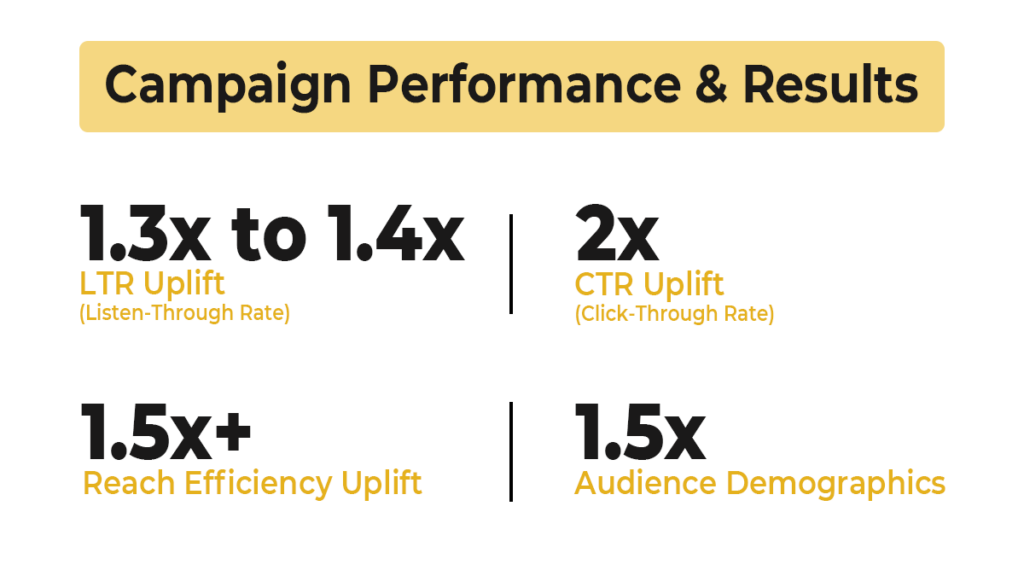

Campaign Performance & Results

Listen-Through Rate (LTR) Uplift: 1.3x to 1.4x

Listeners consistently stayed through the entire 30-second ad, suggesting strong content resonance and high message absorption. The average LTR far exceeded typical industry benchmarks.

Click-Through Rate (CTR) Uplift: 2x

The companion banners performed exceptionally well—achieving 2x uplift over standard CTR ranges for audio+banner campaigns. Users were not just hearing the message, but taking action.

Reach Efficiency Uplift: 1.5x+

The campaign demonstrated a 1.5x+ improvement in reach-to-impression efficiency, showing that ads were reaching more unique users with better frequency balance compared to standard delivery norms.

Overall Delivery

Despite the strict budget and timeline, the campaign over-delivered on audio spots and maintained consistent engagement—highlighting strong execution without any delivery shortfalls.

Audience Insights & Segmentation

18–24 age group: This was the most responsive audience segment. It not only recorded the strongest LTR performance with over (Audience Demographics) 1.5x uplift but also demonstrated the highest CTR (approx. 2.5x uplift) , making it the campaign’s most valuable cohort in terms of both action and attention.

25–34 segment: Closely followed with a strong 1.4x LTR uplift and 1.3x uplift in CTR. This age band showed meaningful engagement and is ideal for scaling in future campaigns.

35–44 segment: Showed comparatively lower interaction, with LTR uplift around 1x and CTR uplift below 1x. This indicates room to enhance messaging relevance and creative appeal for this group.

Male Listeners:

- Dominated engagement with a consistent LTR uplift of around 1.4x and a CTR uplift of nearly 2.2x.

- Messaging resonated well with male users, driving both attention and clicks across all major platforms.

Female Listeners:

- Showed lower engagement, withLTR uplift close to 1.2x andCTR uplift around 1x

- Although still responsive, this segment underperformed compared to males—highlighting the need for more tailored creatives to improve resonance and action rates.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics like LTR and CTR was primarily driven by mobile-first consumption, validating PayTunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Challenges & Solutions

1.Challenge: Demographic Imbalance

Observation:

The campaign heavily skewed toward male listeners (nearly 70%) and the youngest age group (18–24), with much lower engagement from females and older age brackets.

Solution:

- Tailored Messaging: Develop creative assets and messaging specifically designed to resonate with female listeners and users aged 35–44.

- Platform Targeting: Allocate more impressions to platforms or inventory segments that are known to attract a more balanced or diverse demographic profile.

- Challenge: Fluctuating Click-Through Rates (CTR)

Observation:

Daily CTRs varied, with some days showing noticeably lower engagement, indicating inconsistent user interaction with companion banners.

Solution:

- Creative A/B Testing: Introduce multiple versions of companion banners and audio scripts to identify which combinations drive higher engagement.

- Performance Monitoring: Implement daily monitoring to quickly spot dips in CTR and adjust creatives or targeting strategies in real time.

Key Learnings

Audio + Visual = Performance: Combining audio with banners worked, especially when the message and visuals were tightly aligned.

30-Second Format Works Best: Just long enough to explain, short enough to hold attention—helped drive LTR uplift.

High-Frequency ≠ High Impact: Thanks to frequency capping, engagement remained healthy without listener fatigue.

Platform Mix Matters: A balanced distribution helped scale efficiently and explore new listener segments.

Why This Matters for Your Brand

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

In the StockGro campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy. Here’s why it matters:

- The campaign saw average Listen-Through Rates (LTR) of 1.3x–1.4x industry norms, with youth cohorts (18–24) exceeding 1.5x.

- This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

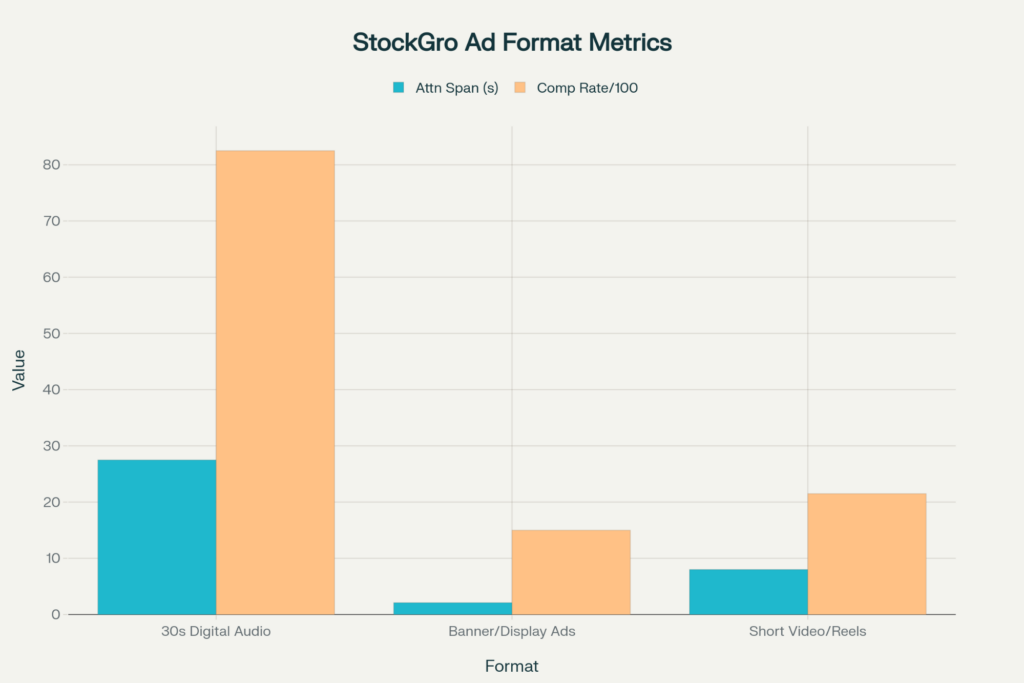

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads |

2–3 |

12–18 |

4–8x lower than audio |

| Short Video (Reels) |

5–9 |

18–25 |

3–4x lower |

| Full Video (In-Stream) |

7–10 |

15–25 |

3–5x lower |

| Audio (30s spot) |

≥25 |

70–95 |

3–8x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 3–8x more completion events per 100 impressions than most display or short video placements.

Image – Comparison of Average Attention Span and Completion Rate Across Ad Formats in StockGro Campaign

Summary

With PayTunes’ targeted digital audio solution, your message isn’t competing with a thousand distractions—it’s being heard, from start to finish. The attention delivered translates directly to higher brand recall, greater message retention, and increased user action. In the attention economy, audio is the most cost-effective, high-performance channel for brands seeking real engagement and business outcomes.

External Source References

- BBC — The average human attention span

https://www.bbc.com/news/health-38896790 - Lumen Research: Banner ad attention benchmarks

https://www.lumen-research.com/blog/attention-in-digital-advertising - TikTok for Business: Average view times

https://www.tiktok.com/business/en/blog/video-views-study - Business of Apps: Instagram Reels engagement statistics

https://www.businessofapps.com/data/instagram-reels-statistics/ - IAB: Audio advertising effectiveness report

https://www.iab.com/insights/audio-advertising-state-of-the-nation-2023/

Google/Samsung: Mobile ad attention span research

https://www.thinkwithgoogle.com/marketing-strategies/app-and-mobile/mobile-page-speed-new-industry-benchmarks/