Campaign Overview / Background

As part of the Gemini Edibles Digital Audio Strategy, a 20-day audio-first campaign was launched for Freedom Rice Bran Oil to strengthen brand equity across South India’s metro and tier-1 cities. Partnering with Rabbit Digital and leveraging premium platforms such as PayTunes, the campaign combined impactful audio creatives with companion banners to engage a health-conscious, mature audience effectively.

Objectives

- Drive higher brand visibility and uplift in urban geographies.

- Maximize listen-through (LTR) and click-through (CTR) engagement via premium digital audio channels.

- Generate insightful demographic and regional performance analytics.

Strategy & Execution

Platform Diversification: Channels like Wynk, JioSaavn, YouTube Music, and PayTunes were activated to ensure extended reach with minimal audience duplication.

Creative Mix: Crisp, locally adapted 30-second audio spots were paired with static banners to reinforce messaging consistency across touchpoints.

Regional Allocation: Hyderabad, Visakhapatnam, and Vijayawada were prioritized, with budgets tuned to historical brand affinity and delivery potential.

Responsive Tracking: Daily and regional-level monitoring, as shown in Excel logs, facilitated tactical in-flight adjustments, optimizing outcomes without additional cost.

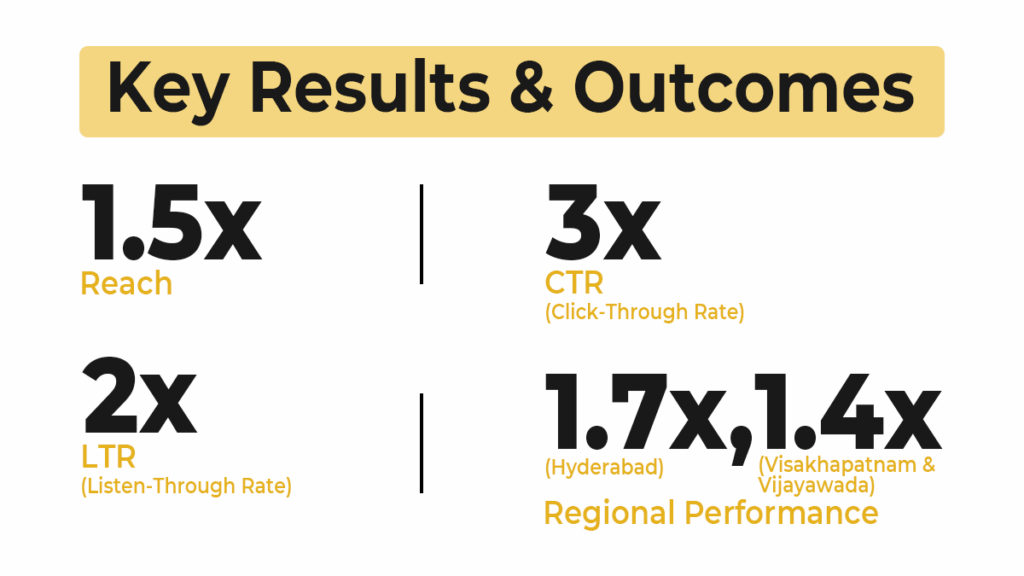

Key Results & Outcomes

Extended Reach: The campaign surpassed initial benchmarks by over 1.5x, especially in Hyderabad, underscoring effective platform and geography mix.

Peak Engagement Performance:

- LTR and CTR uplifts peaked at up to 3x over baseline on certain high-performing days and platforms.

- PayTunes in particular showed over 1.4x LTR uplift during peak delivery windows, affirming its fit for audio-led brand narratives.

Efficient Spend: Frequency caps, city-specific targeting, and pacing control contributed to a noticeable improvement in cost-efficiency compared to prior activations.

Note: For PayTunes, LTR, CTR and Reach % served as primary engagement proxies; peak LTR uplift values here represent top observed daily performance, not an average across the campaign.

Audience Demographics & Segmentation

Male 45+ Audiences: Demonstrated up to 2x LTR uplift on peak days—this engagement was notable but concentrated in metro cities, especially Hyderabad and select tier-2 zones.

Females 35–44: Saw moderate uplift (~1.2x) in engagement, with strongest resonance in secondary cities like Visakhapatnam and Vijayawada. Still under-indexed overall.

Younger Cohorts: Engagement from under-35 audiences lagged across both genders, even after creative tweaks—indicating a clear opportunity for differentiated messaging and refined media placement in future phases.

Daypart/Timing Insights

Weekday Superiority: Midweek (especially Tues–Thurs) saw peak LTR and CTR uplifts of ~1.3x compared to off-peak days.

Weekend Drop-offs: Saturdays and Sundays consistently trailed, with engagement dipping as listener routines shifted. Reallocation to weekdays delivered higher returns.

Geographic/Regional Performance

Hyderabad: Led in total impressions and engagement, with peak daily LTR uplift reaching 1.7x above the campaign norm. This outperformance was especially prominent in male 45+ audiences.

Visakhapatnam & Vijayawada: Both exceeded legacy benchmarks. Vijayawada, in particular, delivered stronger than expected CTR performance, with LTR uplift peaking around 1.4x. Gains were concentrated among working-age male segments.

Key Learnings & Takeaways

- Audio-first campaigns are well suited for health-focused FMCG categories—especially when combined with tailored regional messaging.

- Audience segmentation and geo-specific allocation enabled focused cost optimization and sharper delivery results.

- Real-time data-led pivoting—by city, platform, and creative—was key to extracting performance lift during the campaign window.

- Monitoring LTR and frequency caps delivered both brand safety and attention optimization.

Device-Type Insights

Mobile-first audience confirmed:

Over 98% of impressions came from mobile devices—primarily Android (87.74%) and iOS (10.92%).

Minimal desktop or tablet reach:

Less than 1% of engagement came from desktops, tablets, or smart devices—reaffirming the mobile-centric nature of the campaign.

Optimized creative fit:

The strong LTR and CTR uplifts observed align with high mobile exposure, confirming that the audio + banner formats were well-optimized for mobile-first delivery.

Challenges & How They Were Addressed

Inconsistent Data Structures: Multiple source types (Excel + Sheets) made early analysis complex. Streamlining naming conventions and QA checks ensured consistency in insights.

Engagement Gaps in Key Segments: Performance gaps in female and younger audience segments prompted on-the-fly creative and placement tweaks. While partial recovery occurred, these remain priority areas for improvement.

Recommendations for Future Campaigns

Deeper Demographic Targeting: Invest in more custom creative variants and alternate media environments for female and Gen-Z cohorts.

Automation in Reporting: Create standardized dashboards to streamline data extraction across platforms and publishers.

Continuous Daypart Testing: A/B test weekday segments further—especially morning and early evening windows.

Broaden Publisher Mix: Explore additional audio-native platforms and voice-enabled channels to deepen LTR potential.

Also Read Another Case Study – Hero MotoCorp Audio Campaign

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has dropped to around 8 seconds—shorter than ever before. For brands, it’s no longer enough to simply grab attention—they must hold it long enough to drive meaningful impact.

The Problem: Fleeting Attention on Most Digital Platforms

Banner and display ads typically retain user attention for only 1.6–2.6 seconds before users scroll away or disengage.

Short-form videos and reels average just 7–9 seconds of viewer focus before being skipped or swiped.

This fleeting interaction leads to lower recall, shallow engagement, and minimal follow-through on brand messaging.

The Unique Edge of In-Stream Digital Audio

In the Gemini Edibles campaign, only 30-second in-stream digital audio ads were used—paired with clickable companion banners. No video or alternative audio formats were included, ensuring a pure-play audio-first experience.

Here’s why that mattered:

- The campaign achieved Listen-Through Rate (LTR) peaks of 1.3x–1.7x compared to industry benchmarks, especially during optimized weekday slots.

- On platforms like PayTunes, peak LTR uplift reached over 1.4x, with strong retention across mature health-conscious segments (particularly males 45+).

- This shows that a significant portion of the audience listened through the full ad duration, outperforming typical visual formats in sustained engagement.

- In a landscape defined by scrolling and skipping, audio creates space for uninterrupted storytelling—a key ingredient in building brand memory and long-term affinity.

Gemini Edibles Ad Execution –

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot – Gemini Edibles) | ≥24 | Estimated 85–95 (peak days/platforms) | 3–6x higher vs. traditional formats |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads commanded focused, multitasking-friendly attention—achieving an estimated 85–95 completions per 100 impressions on peak days, resulting in 3–6x more completion events than most display or short video placements.

Let PayTunes Amplify Your Brand’s Impact

Whether you’re in FMCG, retail, or consumer tech, PayTunes helps you turn audio moments into measurable engagement. Deliver high-impact audio campaigns that captivate, convert, and drive loyalty.

Start your journey with PayTunes today.