AMFI × Paytunes Digital Audio Campaign Case Study

Campaign Overview

The Association of Mutual Funds in India (AMFI) is the apex body of the Indian mutual fund industry, focused on building investor awareness, trust, and long-term financial literacy across the country. In May, AMFI partnered with Paytunes to run a 15-day digital audio campaign aimed at educating financially aware adults and nudging them towards informed investment behaviour. The campaign used premium audio platforms such as Wynk, JioSaavn, and Pocket FM, supported by companion banners, to place AMFI’s educational message in high-attention listening environments across both leading and emerging cities.

Objectives

- Drive incremental reach beyond AMFI’s existing media channels, measured through reach uplift above the baseline.

- Maintain strong listen quality by improving LTR, ensuring users stay engaged with the audio message.

- Improve CTR from audio-plus-banner placements to signal stronger intent and curiosity for AMFI’s content.

- Establish digital audio as a brand-safe, scalable channel for BFSI communication across T-30 and B-30 markets.

Strategy & Execution

- Targeted users aged 25 and above with strong BFSI and fintech affinity signals, aligning with audiences closer to financial decision-making.

- Focused on a balanced mix of T-30 and B-30 cities to combine metro scale with emerging investor reach.

- Activated premium audio inventory on Wynk, JioSaavn, and Pocket FM with integrated banner support.

- Used a CPM buying approach to ensure efficient delivery within curated, high-quality listening environments.

- Monitored daily delivery, LTR, and CTR to maintain consistent engagement and optimise pacing across the campaign period.

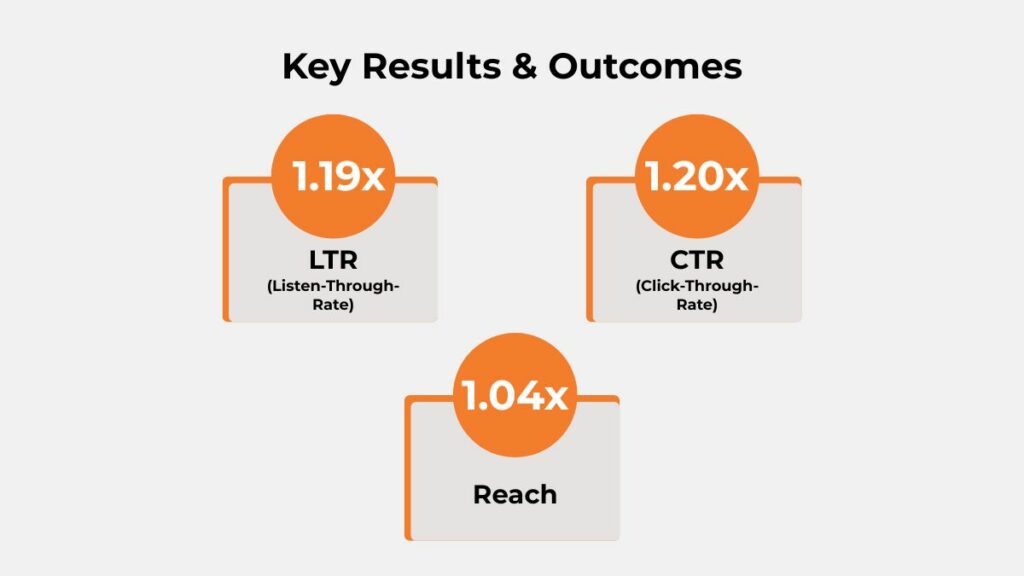

Key Results & Outcomes

- Achieved a 1.19× uplift in LTR, showing that listeners stayed engaged with the audio communication and absorbed the message.

- Recorded a 1.20× uplift in CTR, indicating stronger user action when audio was reinforced with visual banners.

- Delivered a 1.04× reach uplift, extending AMFI’s message to new and relevant audience segments without excessive repetition.

- Observed multiple high-performing days where elevated CTR aligned with consistently strong LTR, reflecting effective creative and context fit.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

AMFI Ad Execution –

Audience & Segmentation Insights

- Successfully reached the core 25+ audience aligned with AMFI’s focus on financially active and emerging investors.

- BFSI and fintech interest targeting helped concentrate impressions among users more receptive to mutual fund education.

- Audio formats blended naturally into daily routines such as commuting, working, and leisure, increasing receptivity.

- Interest- and age-based filters reduced wastage while still delivering meaningful incremental reach.

Timing & Engagement Insights

- LTR remained stable throughout the campaign while certain days showed noticeably higher CTR.

- This pattern indicates that the message resonated consistently, with some days offering stronger click intent.

- Future activity can prioritise time blocks and days that historically delivered higher CTR.

- Since LTR stayed strong even on lower-CTR days, optimisation can focus on refining calls to action rather than changing the core message.

Geographic Performance

- The campaign intentionally covered both T-30 and B-30 cities to support AMFI’s nationwide investor education mandate.

- Top cities likely contributed higher-intent engagement, while emerging cities added incremental reach.

- This dual-market approach supports long-term financial literacy goals rather than short-term performance alone.

- Digital audio proved effective across diverse regional contexts without compromising engagement quality.

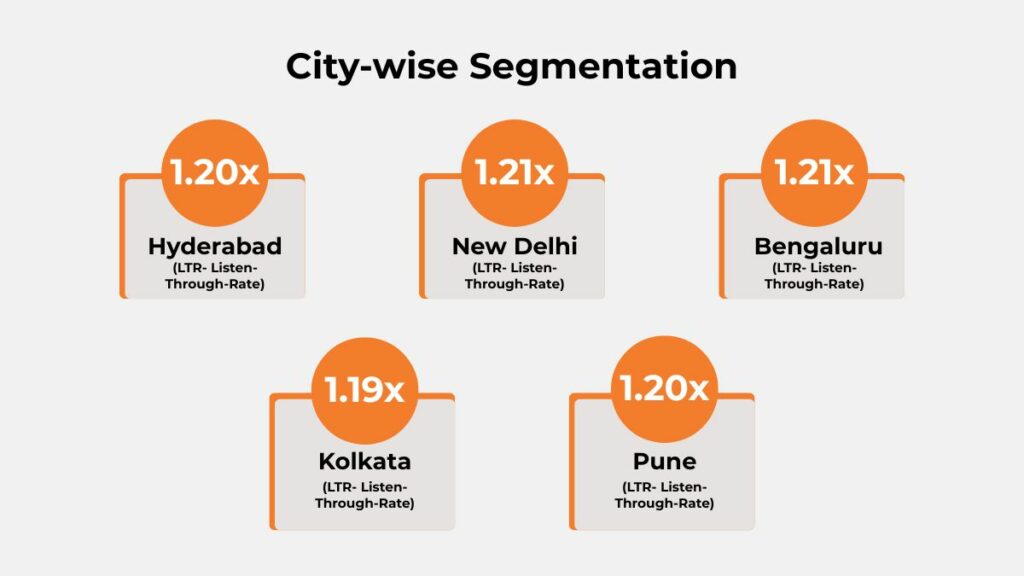

City-wise Segmentation

The campaign delivered strong Listen-Through Rate (LTR) uplift across key metro markets. When benchmarked against the baseline, the following cities emerged as the top LTR performers, each demonstrating notable x-wise uplift and higher-than-average listener attention.

- Hyderabad (1.20× uplift): Strong uplift reflects focused listening and effective audio message delivery.

- New Delhi (1.21× uplift): Above-benchmark uplift highlights consistent engagement and attentive urban audiences.

- Bengaluru (1.21× uplift): One of the highest uplifts, indicating exceptional creative resonance in a digitally mature market.

- Kolkata (1.19× uplift): Solid uplift points to steady listener attentiveness and strong audio receptivity.

- Pune (1.20× uplift): Reliable uplift showcases sustained engagement and quality audio consumption.

Key Learnings

- Digital audio via Paytunes delivered simultaneous uplift in reach, LTR, and CTR for a BFSI education campaign.

- A clear and informative audio message can sustain high listen-through even across platforms and days.

- Audio combined with companion banners improves response without reducing attention quality.

- Targeting 25+ BFSI-aligned audiences across T-30 and B-30 cities offers a strong balance of scale and relevance.

Challenges & Responses

- Variation in CTR across days: Addressed through daily monitoring and optimisation while preserving strong LTR.

- Multiple platforms and formats: Insights from this campaign can guide more granular tagging and reporting in future activations.

Recommendations for Future Campaigns

- Use Paytunes premium audio inventory as a core channel for BFSI and financial education initiatives.

- Introduce deeper audience segmentation within the 25+ group to further improve CTR.

- Test multiple audio scripts and CTAs to identify narratives that drive higher action.

- Apply structured day- and time-based optimisation using index-based performance benchmarks.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the AMFI campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.19x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.19x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements

Conclusion

The AMFI digital audio campaign with Paytunes shows how well-targeted audio can deliver meaningful improvements in reach, LTR, and CTR within a short 15-day window. With a 1.04× reach uplift, 1.19× LTR uplift, and 1.20× CTR uplift, the campaign validates digital audio as a high-attention, scalable channel for investor education. If you want to build deeper engagement and incremental reach through premium audio, connect with Paytunes and explore how sound can strengthen your next BFSI campaign.

Also Read – Spotify Advertising

Another Case Study – Cetaphil BHR Cleanser Audio Campaign Case Study: Driving Beauty Discovery with Paytunes