Sujata Mixer’s Kerala Festive Audio Campaign: A Performance-Driven Case Study

Introduction

Sujata is one of India’s most trusted kitchen appliance brands, known for its powerful mixers and long-lasting performance across households. Ahead of the festive period in Kerala, the brand partnered with Paytunes for a focused 16-day digital audio initiative in August. The goal was to connect with active consumers in the 25–44 age group and reinforce Sujata’s strength, reliability, and everyday relevance. This case study highlights how a simple audio-first strategy, combined with companion banners and precise mobile targeting, generated strong listen-through quality and effective engagement across key Kerala markets.

Campaign Overview

This regional audio campaign used 20-second creatives paired with companion banners across premium streaming apps and gaming inventory. Paytunes activated parallel male and female targeting streams on JioSaavn, Wynk, Pocket FM, Zeno Radio, and 850+ audio apps to ensure wide coverage and balanced delivery within the 25–44 audience.

Objectives

- Maximize efficient audio reach among 25–44 audiences in Kerala while improving CTR on companion banners through relevant placements and controlled frequency.

- Maintain strong LTR as the primary indicator of message fit and listener completion across mid-length audio ads.

Strategy & Execution

- A dual-line-item structure by gender, with equal budgets and identical impression goals, enabled a clear comparison of responsiveness and dynamic adjustments as needed.

- A multi-platform supply approach ensured scale across major music apps and select audio networks.

- Daily monitoring of LTR, CTR, and pacing helped refine delivery and protect completion quality.

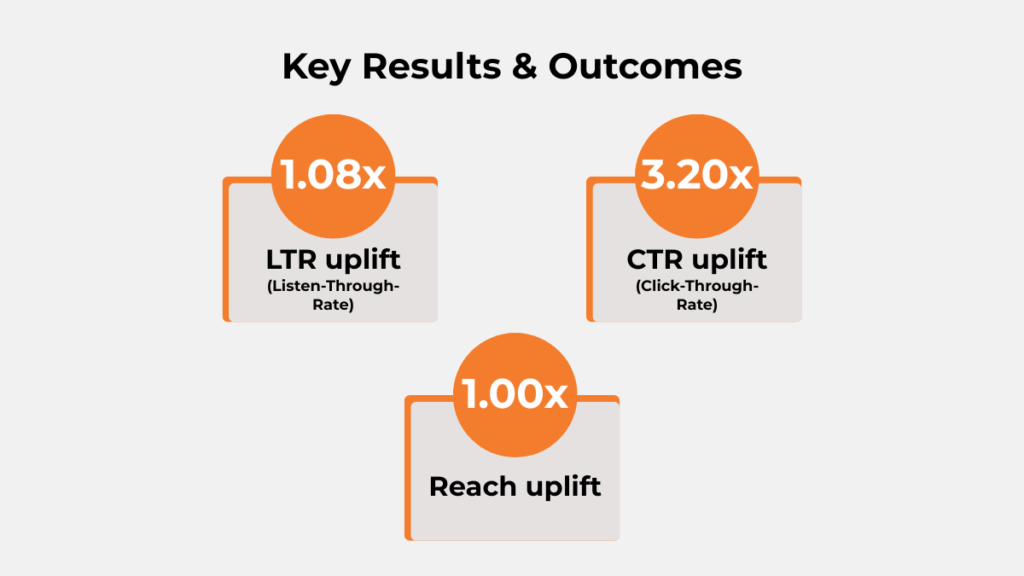

Key Results & Outcomes

- The campaign achieved an LTR uplift of 1.08×, demonstrating that a strong share of listeners completed the audio message.

- The CTR uplift reached 3.20×, indicating that the companion banners effectively encouraged users to take action.

- The reach uplift stood at 1.00×, confirming that the campaign successfully maintained its planned audience scale.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR, were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Sujata Mixer Ad Execution

Audience Demographics & Segmentation

- Male and female segments each achieved robust scale; female skew showed a higher CTR tendency, while male skew demonstrated a marginally higher LTR, suggesting creative and message alignment differences by gender cohort.

LTR Uplift (x-wise)

- Female: 1.07×

- Male: 1.09×

CTR Uplift (x-wise)

- Female: 4.07×

- Male: 3.03×

- The 25–44 focus delivered consistent completion with modest variance by day, indicating the audio length and companion banner pairing were well-tuned for this age band.

Daypart/Timing Insights

- Delivery ramped meaningfully after the campaign start, with two mid-campaign peaks followed by a brief quality dip in LTR on select dates, then recovery—consistent with aggressive scaling windows and subsequent optimization.

- Weekday windows appeared to concentrate the largest delivery bursts and click surges, suggesting that commuter or workday listening cycles lifted CTR without materially harming LTR.

Geographic/Regional Performance

- Kerala-focused activation matched planning intent, with platform distribution implying both tier-1 music apps and extended audio inventory contributed; performance variance across partners suggests that tightening allocations toward top-yield supply could improve LTR and CTR further.

- Localized frequency and pacing helped maintain LTR stability across most days, reinforcing that regional audio consumption patterns can support completion at the planned spot length.

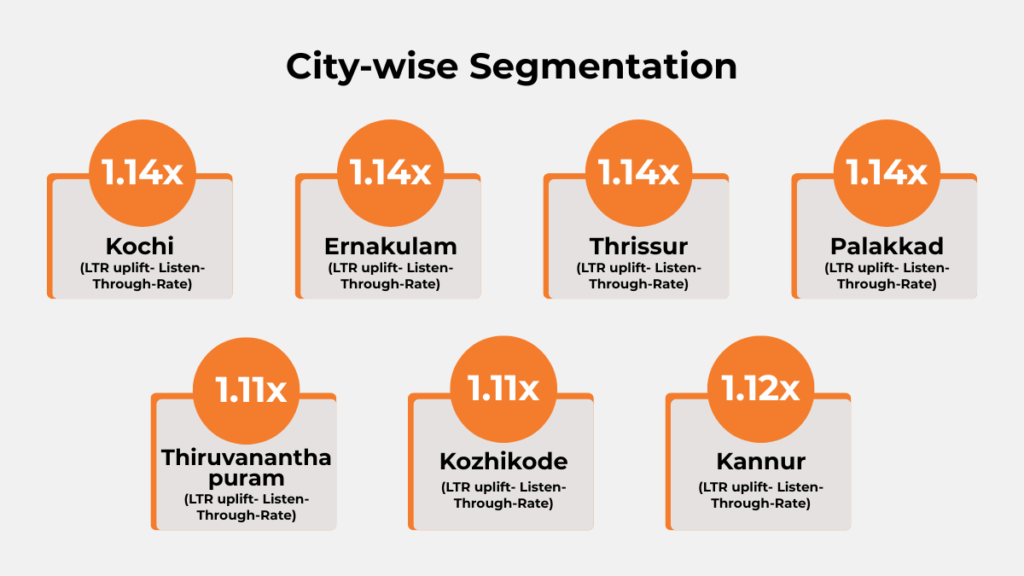

City-Wise LTR Segmentation (Kerala)

Kerala emerged as a high-attention region for the campaign, with multiple cities consistently delivering strong Listen-Through Rates. The state’s highly engaged digital audience, strong music-app adoption, and stable streaming behaviors contributed to above-average LTR performance across key markets. Several cities clustered in the 1.14× uplift range, indicating exceptional message retention and strong creative relevance.

Top Performing Cities (Highest LTR Uplift – 1.14×)

Kochi – 1.14×

Kochi delivered one of the strongest uplifts, reflecting highly engaged listeners across both music and spoken-audio formats.

Ernakulam – 1.14×

Ernakulam matched Kochi’s performance, benefiting from dense urban listenership and high streaming consistency.

Thrissur – 1.14×

Thrissur exhibited strong attention quality, showing minimal drop-offs throughout the audio experience.

Palakkad – 1.14×

Palakkad also performed exceptionally well, contributing significantly to the overall LTR strength within Kerala.

Strong Performers (1.11×–1.12× Range)

Thiruvananthapuram – 1.11×

Kerala’s capital recorded stable LTRs, supported by a mature digital audience base.

Kozhikode – 1.11×

Kozhikode sustained strong engagement, maintaining high message completion throughout delivery.

Kannur – 1.12×

Kannur delivered reliable LTR uplift, showing solid message fit among young and mid-age listener segments.

Key Learnings & Takeaways

- Gender-based targeting helped uncover distinct strengths: female audiences leaned toward higher CTR, while male audiences delivered slightly stronger LTR.

- Sudden scaling can soften LTR temporarily; gradual pacing and historically strong partners help maintain balance.

Challenges & How They Were Addressed

- Temporary dips in LTR were addressed by carefully moderating pacing and prioritizing high-quality inventory.

- Varying partner performance required continuous allocation adjustments to stabilize both LTR and CTR.

Recommendations for Future Campaigns

- Introduce gender-tailored creative variants to build on observed strengths in future campaigns.

- Maintain predefined LTR guardrails during scale-up and rely on top-performing partners to preserve quality and engagement.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Sujata Mixer campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rate (LTR) of approximately 1.08x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.08x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Sujata × Paytunes campaign delivered resilient LTR, strong CTR uplift, and balanced reach across Kerala’s digital-first audience during the festive window. With clear message recall, healthy listener completion, and standout city-level performance, the campaign demonstrated the effectiveness of audio plus companion banners for brand-driven and action-driven outcomes.

To unlock similar audio-led results for your brand, connect with Paytunes for a customized plan tailored to your audience and performance goals.

Also Read – Timezone Audio Campaign Case Study with Paytunes