Case Study: Nilkamal × Paytunes Digital Audio Campaign

Campaign Overview / Background

In October, 2024, Nilkamal, one of India’s most trusted home and furniture brands, collaborated with Paytunes to run a 20-day digital audio campaign across Bengaluru and Hyderabad. The campaign used 30-second audio ads paired with companion banners in Kannada and Telugu to maximise attention, reach, and response. Delivery spanned JioSaavn, Wynk, YouTube, and programmatic audio partners to ensure scale, premium listening environments, and seamless routing to city-specific landing pages. The approach focused on efficient frequency, strong completion rates, and responsive clicks to local offers and store discovery.

Objectives

- Maximize high-quality Reach across both metros without unnecessary frequency build-up.

- Maintaining strong LTR while driving CTR on companion banners to confirm message clarity and creative impact.

- Compare performance across platforms and cities to guide future allocation and localization for Nilkamal.

Strategy & Execution

- A city-first approach using localized language creatives and metro-specific landing pages to reduce friction, strengthen LTR through relevance, and improve post-click intent.

- A diversified platform mix designed to support LTR and CTR together: JioSaavn and Wynk for strong LTR and consistent completions, YouTube for higher CTR responsiveness, and programmatic audio for incremental Reach and cost control.

- Day-level pacing optimization to maintain stable LTR, build steady momentum, and manage frequency effectively while supporting overall delivery.

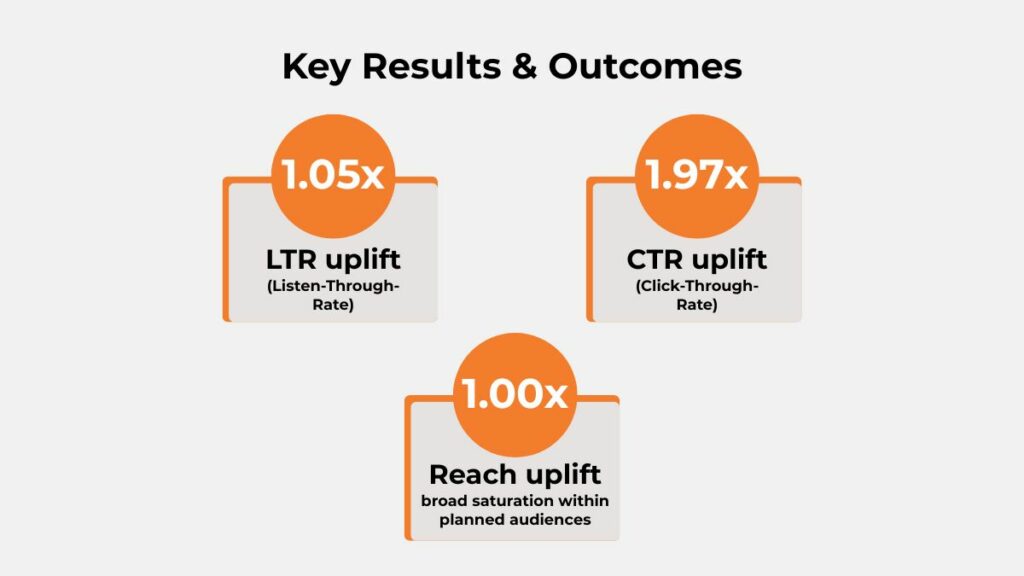

Key Results & Outcomes

- LTR uplift: 1.05x, indicating a positive improvement in listen-through rates while scaling delivery.

- CTR uplift: 1.97x, reflecting a significant increase in click responsiveness driven by companion banners and platform mix.

- Reach uplift: 1.00x, showing broad saturation within planned audiences with disciplined frequency.

Note: Paytunes evaluates LTR and CTR as core engagement indicators; here, Reach and CTR represent the primary outcome metrics.

Audience Demographics & Segmentation

Targeting focused on audiences aged 25–44 across both genders, including key affinity groups. Aligning creatives with local languages (Kannada and Telugu) improved relevance and helped maintain LTR while boosting CTR. Bengaluru showed higher CTR sensitivity, whereas Hyderabad delivered more stable LTR patterns.

Nilkamal Ad Execution

Daypart & Timing Insights

Late-week and end-of-month days drove stronger CTR without lowering LTR, indicating ideal moments for increased pacing. Early delivery fluctuations suggest that a short warm-up window at campaign start could help reduce initial under-delivery and smooth day-level trends.

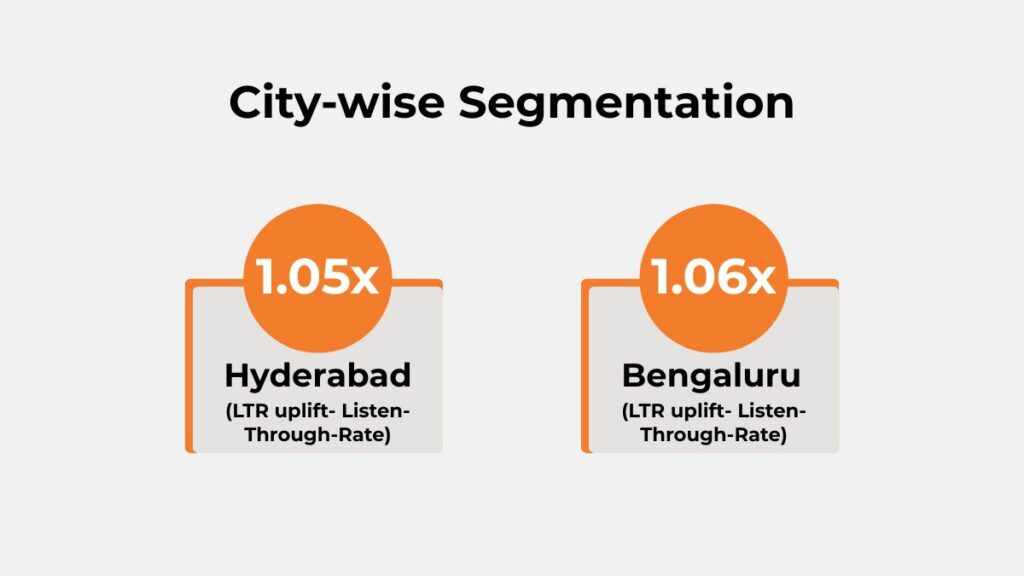

Geographic / Regional Performance

Hyderabad

Hyderabad delivered a balanced performance across core metrics, with:

- LTR uplift: 1.05x, reflecting steady listening quality and strong message retention

- CTR uplift: 2.07x, showing high responsiveness to companion banners and localized creatives.

- Reach uplift: 1.00x, indicating strong coverage within the planned audience.

Bengaluru

Bengaluru showed strong engagement and balanced listening performance, with:

- LTR uplift: 1.06x, indicating consistent listening quality and solid message retention.

- CTR uplift: 1.87x, highlighting strong click responsiveness to companion banners and localized messaging.

- Reach uplift: 1.00x, confirming broad audience coverage.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Key Learnings & Takeaways

- A mixed-platform strategy matters: leading with LTR strength from JioSaavn and Wynk, and combining it with YouTube’s CTR responsiveness, ensures both strong listening quality and meaningful click uplift.

- Local language creatives improve relevance and help sustain LTR while enabling stronger CTR during high-intent periods.

Challenges & Solutions

- Early pacing instability led to under-delivery in the first two days; mid-campaign adjustments improved stability and helped achieve targets.

- Balancing frequency across multiple platforms required careful management to maintain Reach quality and protect LTR.

Recommendations for Future Campaigns

- Use a short calibration period with controlled daily caps to prevent early delivery loss.

- Allocate higher budgets to late-week and end-of-month windows where CTR tends to rise while monitoring LTR for early signs of fatigue.

- Increase allocation to Bengaluru for CTR-led goals, and continue prioritizing Hyderabad when LTR and brand exposure are the focus.

- Retain localized creatives and test offer-based variations to raise CTR without compromising LTR.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Nilkamal campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rates (LTR) of 1.05x higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.05x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements

Conclusion

The Nilkamal × Paytunes campaign demonstrated strong listening engagement, with LTR improvements across both metros, showing that audiences were highly attentive to the 30-second audio messages. Alongside this, the campaign achieved notable CTR uplifts and steady Reach, confirming that city-level targeting, localized creatives, and a multi-platform approach drive both attention and measurable actions. Bengaluru and Hyderabad results highlight the value of tailoring strategies to local audience behaviors for optimal impact. To replicate these results for your brand, schedule a strategy session or request a custom campaign plan with Paytunes to optimize audio delivery, pacing, and localization for your target markets.

Also Read – How Swiss Beauty Drove High Attention with Paytunes’ Audio Ads