Festive Audio Advertising Case Study: Swiss Beauty with Paytunes

Campaign Overview

Swiss Beauty, one of India’s fastest-growing beauty brands known for high-performance yet accessible makeup, partnered with Paytunes for a 17-day festive-season digital audio campaign in October. The approach used an open-platform buy across premium music and audio apps, combining short-form audio ads with companion display units to maximize recall and drive meaningful user actions.

Objectives

- Deliver efficient reach among women aged 18–34 in priority metros during festive shopping periods.

- Sustain high LTR while improving CTR to ensure message clarity, completion, and recall.

- Validate audio plus companion display as a scalable, brand-safe channel during peak demand windows.

Strategy & Execution

Inventory & Format:

Short audio ads (up to 30 seconds) paired with companion banners to boost visual recall and drive site visits alongside audio exposure.

Platform Mix:

Open-platform distribution across YouTube Music, JioSaavn, Wynk, Pocket FM, Zeno, Jagran Radio, and additional premium audio environments to diversify supply and ensure stable pacing.

Targeting:

Women 18–34 across all devices, with a strong metro focus on Mumbai, Delhi NCR, Kolkata, and Ahmedabad to match core demand centers.

Measurement:

Daily monitoring of audio deliveries, LTR, CTR, and reach to guide intra-platform optimization.

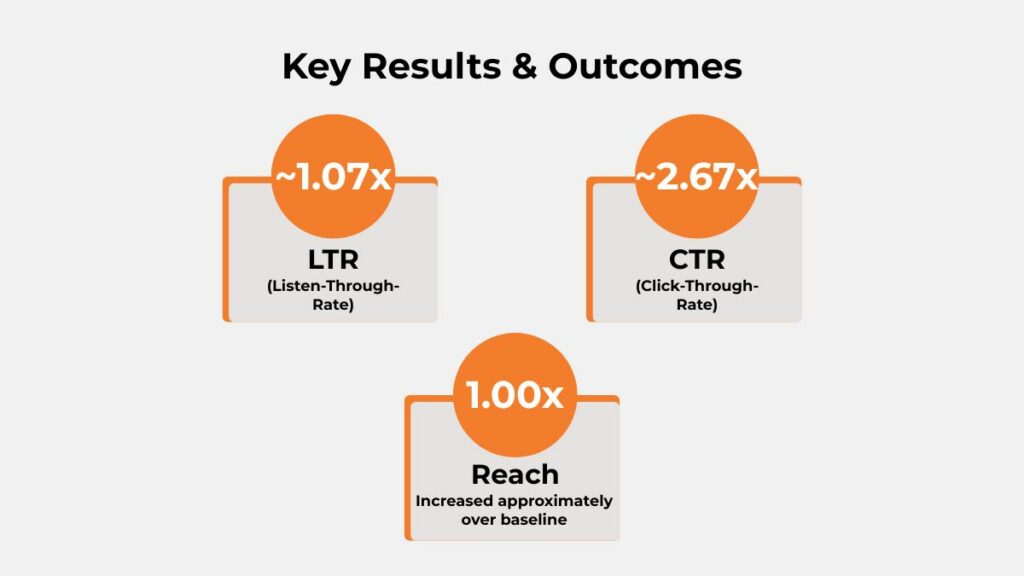

Key Results & Outcomes

- LTR: Achieved a meaningful uplift of 1.07x, maintaining strong completion rates even as scale increased.

- CTR: Improved significantly by 2.67x over baseline, reflecting strong message–audience fit and effective platform execution.

- Reach: Increased to approximately 1.00x over baseline, aligned with unique user targets and frequency controls.

Audience Demographics & Segmentation

- Primary Audience: Women aged 18–34 across devices consistent with beauty category consumption and mobile-first audio habits.

- The segmentation strategy emphasized broad reach in premium audio spaces, complemented by companion banners that reinforced brand touchpoints during listening sessions.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Swiss Beauty Ad Campaign

Daypart & Timing Insights

- Mid-to-late campaign days consistently delivered stronger CTR clusters while maintaining high LTR, indicating clear timing patterns for budget scaling.

- One late-stage day showed unusually low delivery due to supply constraints or guardrails—suggesting refinements to pacing for smoother end-of-campaign consistency.

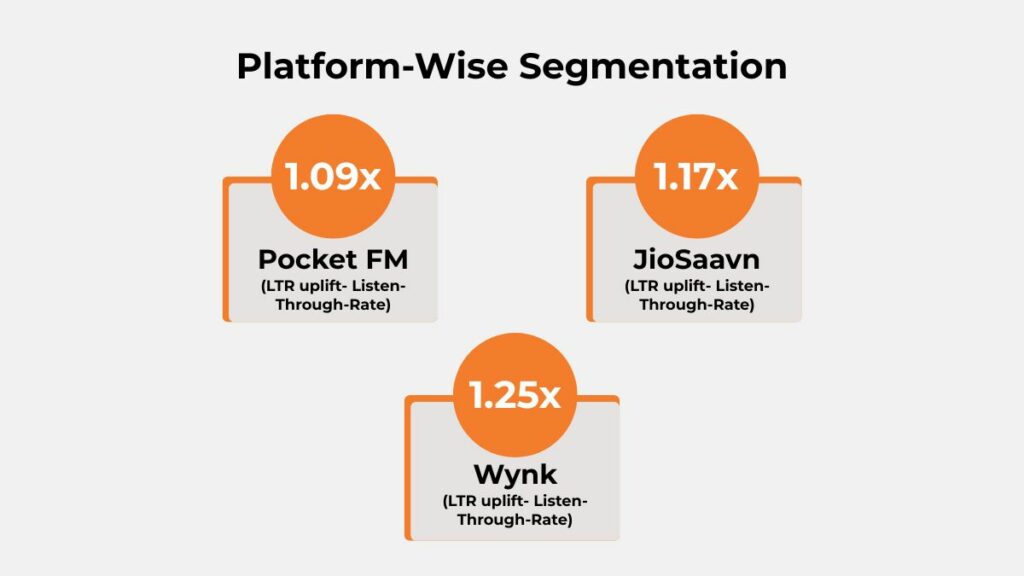

Platform-Wise Segmentation

The campaign performed strongly across all major audio platforms, with each one surpassing the benchmark LTR and contributing to sustained listener attention.

- Pocket FM achieved an LTR uplift of 1.09x, showing strong listener engagement.

- JioSaavn recorded an LTR uplift of 1.17x, indicating high-quality, attentive audiences.

- Wynk generated the highest uplift at 1.25x, demonstrating exceptional listener retention.

Geographic / Regional Performance

Focus metros—Mumbai, Delhi NCR, Kolkata, and Ahmedabad—aligned with dense beauty-shopping audiences and high festive purchase intent, supporting efficient and relevant reach.

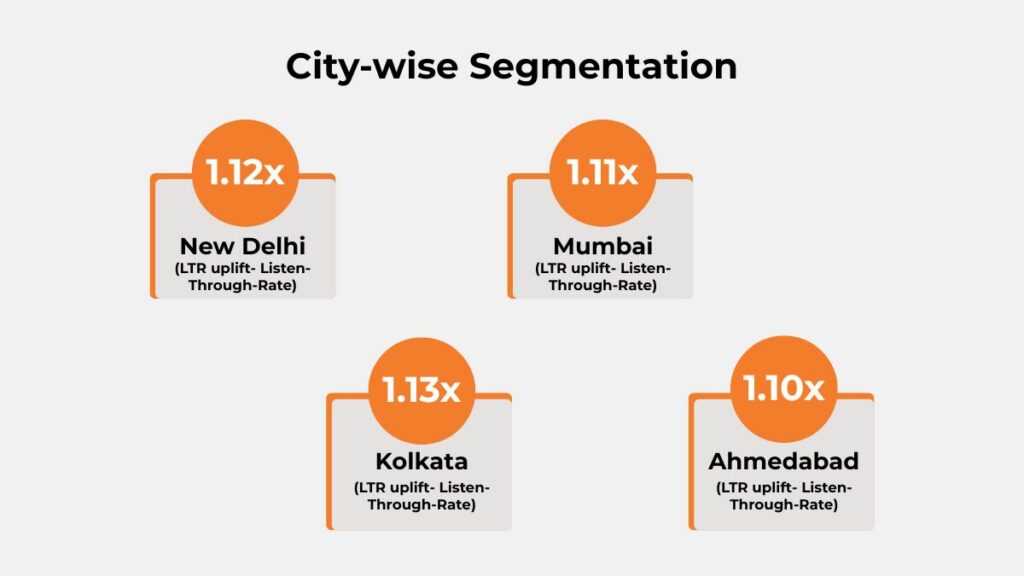

City-wise Segmentation

The campaign delivered strong listen-through performance across all priority metros, with each city exceeding the benchmark.

- New Delhi recorded an LTR uplift of 1.12x, showing strong message retention.

- Mumbai achieved an LTR uplift of 1.11x, reflecting consistent listener engagement.

- Kolkata delivered an LTR uplift of 1.13x, marking the highest completion strength among the cities.

- Ahmedabad saw an LTR uplift of 1.10x, maintaining solid listener attention throughout.

Key Learnings & Takeaways

- Audio paired with companion banners helped improve click performance while still keeping listeners engaged until the end.

- Using a mix of different audio platforms reduced delivery ups and downs and created opportunities for stronger performance, even though some partners did not provide complete reporting.

- Tracking results daily helped identify the best-performing days, which can be used to plan smarter pacing in the future.

Challenges & Resolutions

- Delivery remained strong throughout the campaign, and timely checks ensured that performance stayed consistent even toward the end.

- Platform reporting offered useful insights, and introducing a standardized format in the future will make comparisons even clearer and help unlock even better optimization opportunities.

Recommendations for Future Campaigns

- Use automated budget boosts on days that show stronger performance to get even better results while keeping listener engagement steady.

- Create a standard reporting format for all partners so metrics are consistent and easier to compare.

- Test multiple creative versions to find messages that attract more clicks without affecting completion rates. Focus on strong openings and clear call-to-action alignment with companion banners.

- Try adjusting budgets across different cities to understand which locations respond more effectively during festive periods.

- Add pacing controls at the start and end of campaigns to ensure smooth delivery and avoid any sudden drops.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Swiss Beauty campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign achieved a Listen-Through Rates (LTR) of approximately 1.07x, higher than industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.07x, higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Swiss Beauty × Paytunes campaign proved that combining audio with companion display can deliver meaningful engagement, strong completion rates, and higher user actions during competitive festive periods. By sustaining high listener attention and driving significantly stronger click performance, the campaign showed how well-designed audio strategies can build both recall and response at scale.

If you’re looking to unlock similar performance gains for seasonal pushes or always-on growth, connect with Paytunes to explore how audio-first marketing can elevate your brand’s impact.

Also Read – Federal Bank × Paytunes Case Study: Achieving 1.07× LTR and 5.23× CTR Uplift Through Premium Digital Audio