Federal Bank × Paytunes: Digital Audio Campaign Case Study

Campaign overview/background

In December 2024, Federal Bank partnered with Paytunes to launch a 15-day multi-city digital audio campaign across premium streaming platforms. The campaign paired short-form audio with companion banners to boost brand awareness and drive qualified site traffic for a seasonal offer. Targeting adults aged 20–55 using high-end devices, it employed a CPM-based buying model and standardized 30-second creatives across Bengaluru, Delhi NCR, Mumbai, and Pune.

Objectives

- Maximise reach within defined metros while maintaining quality exposure.

- Improve LTR as a proxy for audio resonance and message fit.

- Drive CTR to the offer landing page, balancing scale with efficiency.

- Validate platform mix for banking audiences across leading music and spoken-word apps.

Strategy & execution

- Premium inventory: Activated Wynk, YouTube Music, JioSaavn, PocketFM, and curated programmatic audio with companion banners for incremental attention.

- Creative: Up to 30-second audio aligned with the banking offer, optimized for clarity in noisy environments and quick value delivery.

- Targeting: Urban metros with high smartphone penetration; adults 20–55; device filters to maintain ad experience quality.

- Controls: Frequency cap set to preserve experience while ensuring repetition; pacing tuned to daily performance signals.

- Collaboration: End-to-end execution powered by Paytunes, including measurement of reach, LTR, and CTR as primary success metrics.

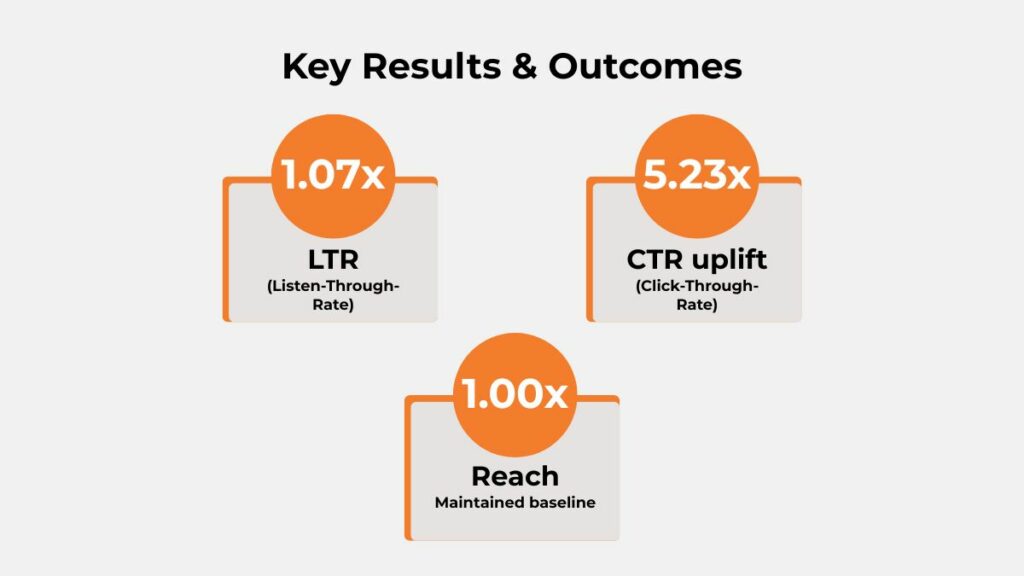

Key results & outcomes

- LTR: Achieved 1.07x improvement, indicating better message retention without compromising scale.

- CTR: Drove a 5.23x uplift, reflecting meaningful gains in site intent and click propensity.

- Reach: Maintained baseline reach at 1.00x across the defined audience footprint, confirming strong metro coverage.

- Daily consistency: Stable LTR with day-level CTR peaks shows optimization worked without sacrificing completion behavior.

Note: For Paytunes LTR, CTR and Reach are the primary metrics; all outcomes are expressed as multipliers or qualitative descriptors.

Audience demographics & segmentation

- Demographic focus: Adults 20–55, inclusive of both genders, aligned with core banking consideration windows.

- Device quality: High-tier devices ensured smooth audio rendering and better banner visibility.

- Segment learnings: Consistent LTR across segments suggests broad message fit; incremental lifts likely came from micro-optimizations rather than drastic audience shifts.

Daypart/timing insights

- Mid-flight spike: A discrete delivery surge coincided with steady LTR, indicating available high-quality inventory that did not dilute attention.

- CTR peaks: Specific days outperformed for CTR, implying tactical windows worth prioritizing with higher bids and more assertive frequency within cap.

- Recommendation: Apply weighted bid and cap strategies to late-week and early-week windows where response strengthened.

Geographic/regional performance

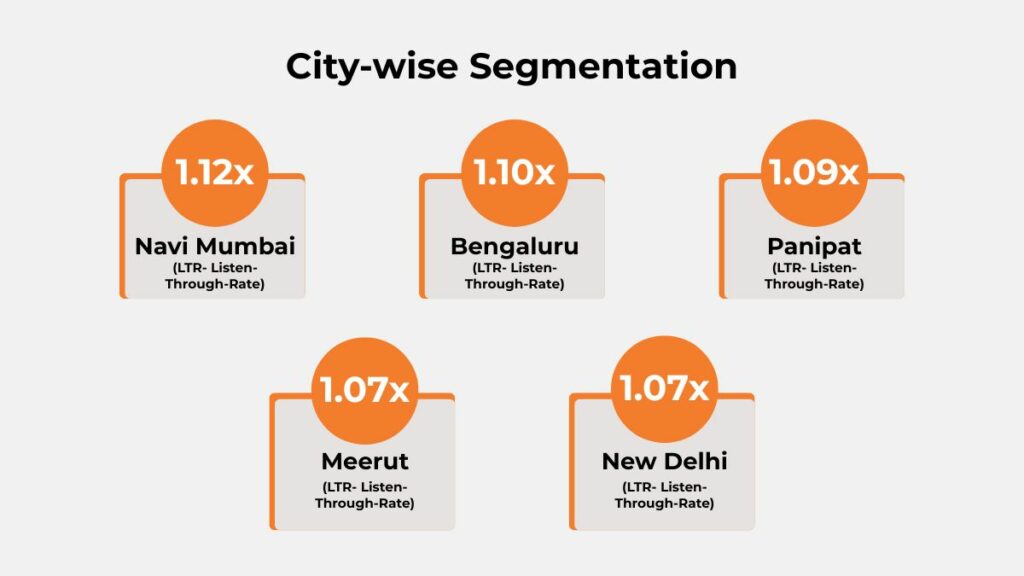

City-wise Segmentation

The campaign’s top-performing cities demonstrated exceptional listener retention, highlighting the strength of Paytunes’ audience targeting across both metro and emerging markets. Below are the five cities that recorded the highest Listen-Through Rates (LTRs), each reflecting distinct engagement patterns driven by regional and demographic nuances:

- Navi Mumbai (1.12x)– Delivered the highest listener retention, reflecting strong engagement with premium urban audiences.

- Bengaluru ( 1.10x)– Showed excellent completion rates, driven by a tech-savvy and high-device-quality audience.

- Panipat ( 1.09x) – Performed strongly in a smaller city cluster, indicating high attention in emerging markets.

- Meerut (1.07x) – Maintained steady LTRs, demonstrating growing interest in non-metro regions.

- New Delhi ( 1.07x)– Sustained high completion levels amid large-scale reach, showing effectiveness across dense metro traffic.

Device-Type Insights

Mobile-first audience confirmed:

Over 98% of impressions came from mobile devices—primarily Android (87.74%) and iOS (10.92%).

Minimal desktop/tablet reach:

Less than 1% engagement from desktop, tablet, or smart devices—reaffirming the campaign’s mobile-first impact.

Optimized creative fit:

Strong LTR and CTR uplifts aligned with high mobile exposure, validating the audio + banner format for mobile-centric delivery.

Federal Bank Ad Execution

Key learnings & takeaways

- Creative resonance: Stable LTR confirms that the audio script, VOs, and pacing resonated across platforms.

- Placement synergy: Audio plus companion banners supported CTR growth without suppressing LTR.

- Optimization cadence: Day-level tuning can unlock CTR gains while protecting reach and completions.

Challenges & resolutions

- Platform imbalance: Limited observed completion contribution from YouTube points to supply, targeting, or trafficking constraints; resolve via inventory mapping and prioritized line items.

- Performance Stability: A few days showed lower delivery, but adjusting pacing and balancing across platforms helped keep performance steady.

Recommendations for future campaigns

- Daypart weighting: Shift more weight to demonstrate CTR-productive windows while monitoring LTR to avoid fatigue.

- Frequency testing: Explore controlled increases around high-intent cohorts to discover the response-maximizing ceiling.

- Creative variants: Test shorter edits and CTA-first intros to compound CTR while keeping LTR steady.

- Platform calibration: Expand proven inventory on Wynk/JioSaavn/PocketFM; retool YouTube Music delivery pathways to capture completions.

- Geo granularity: Layer micro-geo segments (business hubs, transit corridors) to scale qualified reach without expanding markets.

- Measurement: Maintain reach, LTR, CTR as the core stack; add brand-lift pulses for message recall verification.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

In the Federal Bank campaign, 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed, no other audio or video formats were part of the strategy. Here’s why it matters:

- The campaign achieved a Listen-Through Rate (LTR) approximately 1.07x higher than industry norms.

- This result means a substantial share of the audience listened all the way through, far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

| Banner/Display Ads | 2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.07x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Federal Bank × Paytunes collaboration delivered strong performance with stable reach, a 1.07x uplift in LTR, and an impressive 5.23x surge in CTR, proving that premium audio, when paired with companion banners, can effectively capture attention and drive meaningful action across competitive metro markets.

Looking to amplify your brand’s impact like Federal Bank? Partner with Paytunes to craft a high-performance audio strategy that boosts CTR and builds lasting listener connections.

Also Read – Union Bank x Paytunes: 1.09x LTR & 4.03x CTR Boost with Digital Audio Campaign