Alcon’s Digital Audio Success Story with Paytunes

Campaign overview/background

Alcon partnered with Paytunes to launch a multi-platform digital audio campaign across JioSaavn, Wynk, and YouTube Music, targeting women aged 25–34 within lifestyle, travel, and premium eyewear interest cohorts across top Indian metros.

Executed over 12 days in November 2024, the campaign utilized Audio + Companion Banner formats with up to 30-second creatives and CPM-based buying to optimize both scale and quality.

The initiative leveraged Paytunes’ dashboard delivery, complemented by YouTube and Wynk allocations, to enhance completion rates and response efficiency across markets.

Objectives

- Maintain or improve Paytunes LTR to validate audio creative resonance and platform quality.

- Maximize Paytunes’ reach and CTR within the defined Female 25–34 target in priority metros.

- Identify high-yield cities and timing windows to inform future optimization and allocation strategy.

Strategy & execution

- Platforms: JioSaavn, Wynk, and YouTube Music, orchestrated via Paytunes to ensure consistent audio delivery and companion banner support for response lift.

- Targeting: Female 25–34 with granular interest overlays (Gen Z, outdoor enthusiasts, travel, party & nightlife, premium eyewear affinities) across Delhi NCR, Mumbai, Bengaluru, Chennai, Pune, Ahmedabad, Hyderabad, and Kolkata.

- Pacing and optimization: The campaign followed a tight schedule with progressive optimization. A late-phase surge indicated strategic reallocation and bid/placement adjustments to boost performance across high-performing segments and dayparts.

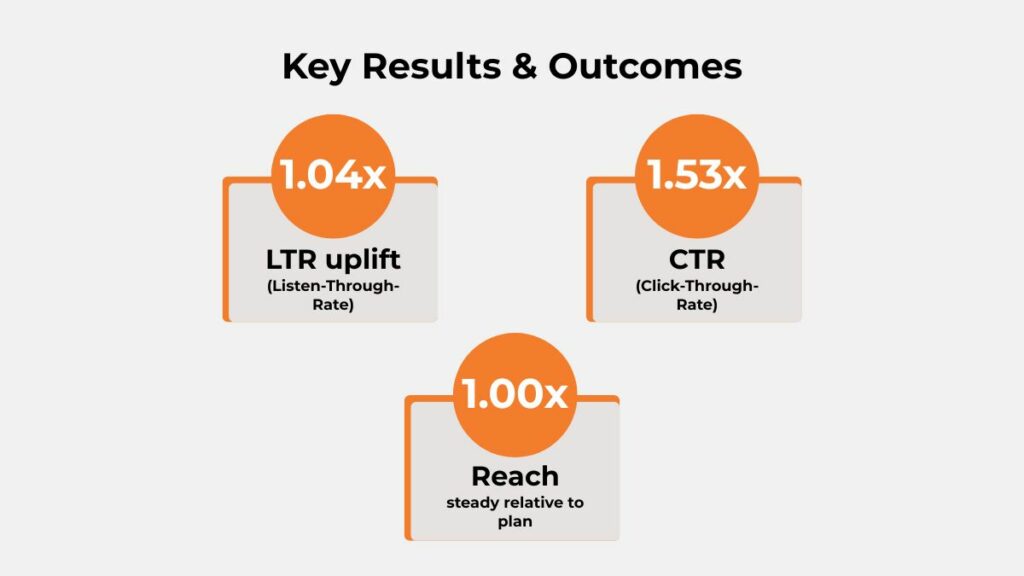

Key results & outcomes

- Paytunes metrics: LTR improved to 1.04x, CTR reached 1.53x, and reach remained at 1.00x vs. plan baseline, indicating stronger response propensity with stable unique exposure breadth.

- Delivery stability: Daily delivery remained consistent with a marked uplift in the final three days, reflecting optimization impact and improved inventory quality mix.

- Platform synergy: Dashboard audio provided the backbone of delivery and completion, while YouTube contributed incremental completions in heavy-delivery days, supporting overall quality.

City-wise Segmentation

- In Hyderabad, the Alcon campaign performed strongly, achieving an impressive 1.14× LTR uplift, indicating high listener engagement.

- Kolkata followed closely, with a solid 1.13× uplift, reflecting consistent audience attention and message retention.

- In Delhi NCR, the campaign maintained strong engagement levels, recording an LTR uplift of 1.08× across its audio placements.

- Bangalore also showed positive results, delivering a 1.10× uplift, highlighting the campaign’s resonance with urban, digital-savvy listeners.

- Mumbai audiences responded well too, with an LTR uplift of 1.12×, demonstrating the campaign’s ability to hold attention in a competitive market.

- In Pune, the campaign achieved a modest yet steady 1.02× uplift, showing stable listener interaction.

- Chennai recorded a slightly lower 0.97× uplift, suggesting potential for deeper localization in future efforts.

- Meanwhile, Ahmedabad showed the lowest 0.85× uplift, offering insights for refining regional creative or targeting strategies.

Audience demographics & segmentation

- Core TG: Female 25–34 with lifestyle and premium eyewear interests consistent with Alcon’s category positioning and consideration triggers.

- Affinity overlays: Travel, outdoor, and nightlife cohorts helped diversify contexts and likely contributed to CTR lift where companion banners were present.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Alcon Audio Ad Execution

Daypart/timing insights

- Early-to-mid flight showed moderate CTR and LTR stability, with the most pronounced efficiency and delivery in the final 3 days of the campaign.

- The late surge suggests daypart and allocation tweaks improved match quality; applying these learnings earlier can create a 1.2x–1.4x efficiency compounding effect in future flights.

Geographic/regional performance

- Top-performing metros: Hyderabad (1.14×) and Kolkata (1.13×) led LTR performance, reflecting high listener engagement and strong message retention. Mumbai (1.12×), Bengaluru (1.10×), and Delhi NCR (1.08×) followed closely, underscoring consistent resonance across major urban markets.

- Mid/lagging metros: Pune (1.02×) showed stable interaction, while Chennai (0.97×) and Ahmedabad (0.85×) trailed, pointing to opportunities for deeper localization, creative refinement, or recalibrated geo-weighting in upcoming waves.

Key learnings & takeaways

- Response quality: A 1.53x CTR against a stable reach base indicates audio-plus-banner synergy worked for intent signaling even without expanding unique exposure, validating creative clarity and platform mix.

- Quality consistency: LTR at 1.04x shows reliable audio completion but with headroom; geo-specific creative and contextual refinements can unlock another 1.1x–1.2x.

- Allocation: Concentrating more impressions in Hyderabad, Bengaluru, and Kolkata is likely to generate a proportional uplift in LTR while maintaining CTR momentum.

Challenges & how they were addressed

- Flat reach: With reach at 1.00x, frequency likely absorbed incremental budget, capping unique exposure growth; pacing rebalancing and inventory diversification late in the flight countered this by boosting CTR and stabilizing LTR.

- Geo variance: Underperforming metros required tighter placement filters and bid adjustments; late‑flight improvements indicate these were partially addressed via reallocation and platform tuning.

Recommendations for future campaigns

- Expand reach by introducing stricter frequency caps and diversifying the media mix to bring in more unique listeners, while keeping engagement levels steady.

- Shift greater focus toward high-performing metros such as Hyderabad, Kolkata, and Bengaluru, while testing smaller allocations in lower-performing regions like Ahmedabad and select Chennai zones.

- Test creative variations with city-specific hooks and shorter 15–20 second formats to boost listener retention and click performance through more relevant messaging.

- Optimize the daypart strategy by front-loading top-performing time slots early in the campaign to maintain steady engagement and improve efficiency over time.

- Use the Paytunes dashboard as the central control point while integrating additional audio platforms for peak days to sustain completion rates and strengthen overall campaign performance.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Alcon campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign saw average Listen-Through Rates (LTR) approximately 1.04x industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 | 4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.04x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Alcon × Paytunes campaign delivered a 1.04× uplift in Listen-Through Rate (LTR) and a 1.53× boost in CTR, all while maintaining strong, consistent reach across key metros. The results highlight how audio paired with companion formats can drive deeper engagement and better performance.

With targeted geo-weighting, end-flight optimizations, and creative-by-city testing, upcoming campaign waves are poised to further lift both LTR and CTR — while expanding reach beyond baseline.

Connect with the Paytunes team to explore a customized test plan or request a demo of our optimization framework.

Also Read – Digital Audio Marketing Success: Aadhar Housing’s Campaign with Paytunes