Aadhar Housing x Paytunes: 1.08x LTR and 2.5x CTR Uplift via Digital Audio

Campaign Overview

In a market where financial decisions rely on trust and transparency, Aadhar Housing turned to the power of digital audio to create meaningful engagement. To enhance awareness and consideration among home finance seekers, Aadhar Housing partnered with PayTunes for a data-driven, multi-platform audio campaign. The campaign began in October 2024 and ran for one month, combining scale, precise targeting, and contextual storytelling—supported by companion banners to boost engagement and drive full-funnel impact.

Objectives

- Maximize reach within a 25–45+ audience across priority states while maintaining strong LTR as a proxy for message resonance.

- Improve CTR through creative and targeting optimizations to support consideration and site visitation.

- Balance delivery across platforms to pair scale (music streaming) with high-intent environments (spoken-word/audio storytelling)

Strategy & execution

An integrated audio-first strategy combined behavioral precision with contextual reach.

- Platforms: A mix of JioSaavn, Wynk, Pocket FM, Zeno Radio, and YouTube Music was selected to balance scale and engagement. Each 30-second audio placement was paired with clickable companion banners to capture real-time intent and drive site visits.

- Targeting: The campaign focused on men and women aged 25–50, using state and pincode-level targeting. A frequency cap of three exposures per user ensured optimal delivery without listener fatigue.

- Optimization: Real-time performance tracking enabled agile mid-flight adjustments. Bid pacing, publisher mix, and timing calibrations were fine-tuned to improve CTR during high-engagement windows while maintaining consistent LTR performance.

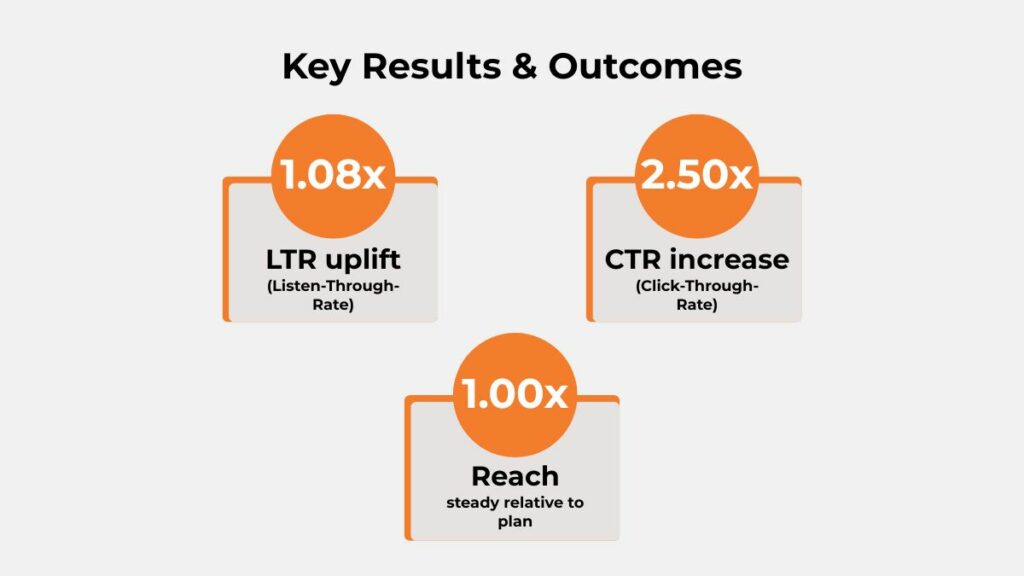

Key results & outcomes

The campaign set new benchmarks for engagement efficiency and audio completion quality.

- LTR improved to 1.08x, reflecting a meaningful lift in audio completion quality over baseline.

- CTR increased to 2.50x, indicating a strong improvement in response propensity following optimizations.

- Reach held steady at approximately 1.00x relative to plan, demonstrating disciplined frequency management without sacrificing scale.

Platform-wise segmentation

Each platform contributed uniquely to the overall media mix.

- Wynk: Delivered the highest completion rate with an LTR uplift of 1.25x; ideal for music-focused sessions where longer listening helps strengthen message recall.

- Pocket FM: Showed strong attention with a 1.08x LTR in long-form storytelling; well-suited for finance education content and mid-funnel engagement.

- Saavn: Offered balanced reach and quality with a 1.07x LTR; reliable for wide audience coverage and steady listen-through rates.

- Zeno: Achieved a 1.01x LTR uplift; effective for low-cost reach extension and maintaining completion levels.

- YouTube Audio: Provided consistent performance with a 1.05x LTR and high volume; supported overall stability across high-performing platforms.

Audience demographics & segmentation

Audience insights highlighted clear behavioral and creative opportunities.

- The audience skews male with the largest share in 35–44 males, followed by 25–34 males, indicating strong resonance among mid-career segments evaluating housing finance options.

- Women contribute meaningfully in 35–44 and 25–34 brackets, suggesting potential for tailored creatives addressing family planning, home upgrade, and security narratives for female decision-influencers.

- The 45+ male cohort forms a substantial secondary segment, aligning with refinance, home expansion, or investment-led messaging opportunities.

- Younger adult females (25–34) are present but smaller relative to male peers, indicating headroom to test context-led placements and creative variants that address first-home aspirations.

- Overall, the 25–44 span remains the core performance band, warranting prioritized frequency, value-prop clarity, and platform mixes that favor high listen-through to reinforce trust and credibility cues

Daypart/timing insights

Smart pacing drove higher engagement across active listening hours.

- Mid-campaign weekdays registered a notable uptick in CTR alongside stable or rising LTR, implying effective pacing and bid adjustments during business and commute windows.

- Specific days exhibited CTR spikes without compromising LTR, pointing to successful creative rotation or inventory improvements.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Aadhar Housing Ad Execution –

State-wise segmentation

- Jharkhand delivered the highest listen-through uplift at 1.12x among the highlighted states.

- Tamil Nadu, Himachal Pradesh, and Uttarakhand each recorded a strong 1.11x LTR uplift, forming a tight second cluster.

- Andhra Pradesh followed closely with a 1.10x LTR uplift, rounding out the top-performing group.

- Himachal Pradesh posted the most substantial CTR uplift at 5.80x, reflecting a standout propensity to click relative to the 0.30 baseline.

- Telangana followed with a 3.87x CTR uplift, indicating highly responsive audiences in the state.

- Punjab delivered a 3.80x CTR uplift, placing it firmly among the top performers for response efficiency.

- Uttarakhand achieved a 3.63x CTR uplift, rounding out the high-performing cluster on click propensity

Key learnings & takeaways

A balanced mix of scale, targeting, and optimization proved key to success.

- Multi-platform diversification strengthened both reach and engagement.

- Frequency capping at three exposures preserved listening quality.

- Mid-flight optimization windows unlocked a 2.50x CTR boost without lowering LTR.

Challenges & how they were addressed

Agile management ensured stability and growth throughout.

- CTR Volatility: Countered through bid calibration and creative rotation.

- State-Level Variance: Delivery realigned toward better-performing states and publishers.

- Data Validation: Platform-level checks ensured accurate measurement and confidence in results.

Recommendations for future campaigns

Actionable next steps to scale and sustain success.

- Scale high-CTR inventory: Prioritize spoken-word Platforms delivering superior response.

- Refine daypart strategy: Focus on commute and evening windows with split creative tests.

- Expand creative testing: Broaden variant pool emphasizing financial value and trust cues.

- Geo micro-optimization: Double down on high-performing districts for incremental lift.

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Aadhar Housing campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign saw average Listen-Through Rates (LTR) approximately 1.08x industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

|

Banner/Display Ads |

2–3 | 12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.08x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Aadhar Housing x Paytunes campaign demonstrated how focused storytelling and disciplined optimization can turn passive listening into active consideration.

The campaign achieved a 1.08x lift in Listen-Through Rate, a 2.50x surge in Click-Through Rate, and a stable 1.00x reach efficiency — showcasing the unmatched value of contextual, data-driven audio engagement.

In a landscape defined by divided attention, this Aadhar Housing Campaign proved that when brands speak through the right channel, audiences don’t just hear — they listen.

Ready to turn attention into action?

Join leading brands partnering with Paytunes to create immersive sound-led experiences that drive both recall and real business outcomes.

Also Read – Palladium Mall Digital Audio Campaign by Paytunes