How Neelkanth Jewellers Drove 1.07× LTR with a Hyperlocal Digital Audio Campaign

Campaign Overview / Background

In April 2025, Neelkanth Jewellers partnered with Paytunes to run a short-duration, hyperlocal audio campaign across multiple streaming audio platforms with companion banners. The campaign targeted store catchment areas via PIN-code and 4km radius geofencing, with the aim of driving both brand consideration and store-page interactions during a concentrated time window.

Objectives

- Increase brand recall and listen-through for in-stream audio creative.

- Drive higher click-throughs to the store/offer landing page (companion banner).

- Maximise local reach within targeted PIN codes around Neelkanth retail locations.

- Maintain cost-efficiency through CPM-based buys across audio inventory.

Strategy & Execution

- Inventory mix: In-stream audio ads paired with companion banners across major audio platforms (Spotify, JioSaavn, YouTube Music, South Radio, Mirchi Radio etc.).

- Geo-targeting: PIN-code focused delivery and 4 km radius around key store locations to encourage store visits and local consideration.

- Creative approach: Short, attention-grabbing audio (up to 30 secs) with a localized call-to-action; companion banners designed for immediate click-through to store pages or booking forms.

- Buy type & pacing: CPM buys scheduled over a compressed window to create frequency saturation in the catchment area.

- Measurement : LTR, CTR and Reach used as primary engagement KPIs (Paytunes’ standard engagement set).

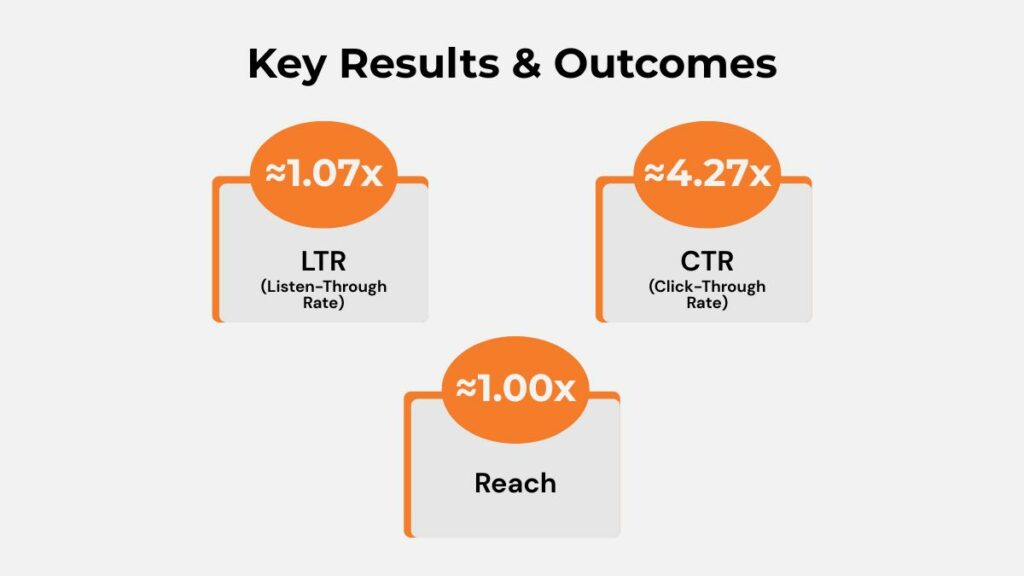

Key Results & Outcomes (expressed in multipliers / qualitative terms)

- LTR (Listen-Through Rate): Delivered a modest uplift in completion rate (≈ 1.07×), indicating strong creative retention relative to norms.

- CTR (Click-Through Rate): Achieved a significant uplift in CTR (≈ 4.27× benchmark), indicating companion banners and the creative effectively drove visits and interactions.

- Reach: Delivered parity with target reach (≈ 1.00× target), showing the geo approach reliably reached the intended local audience.

- Overall: The campaign combined excellent click performance with steady listen completion — a desirable balance for retail activations where both attention and action matter.

Audience Demographics & Segmentation

- Geo-first segmentation: Primary targeting by PIN code and store radius — effective for driving store-centric traffic.

- Likely audience profile: Urban, music-streaming users within store catchments. (Explicit age/gender splits not present in the sheet; adding platform demographic exports would enrich the analysis.)

- Opportunity: Segmenting by first-time vs repeat visitors (or by interests where platform data allows) could further increase CTR performance.

Neelkanth Jewellers Ad Execution –

Pincode-wise Segmentation

This campaign was executed across the Bengaluru metropolitan region. For this geographical performance analysis, we are focusing on Spotify and JioSaavn platforms (excluding YouTube Music) with Listen-Through Rate (LTR) as the key indicator of engagement and audience interaction.

Among the Bengaluru pincodes targeted, the following locations emerged as the top performers, demonstrating the highest LTRs relative to campaign benchmarks:

- 560066 (Whitefield): LTR uplift of 1.23×, reflecting exceptional ad completion and sustained listener attention.

- 560105 (Bangalore South): LTR uplift of 1.23×, signifying excellent audio engagement in a highly tech-centric area.

- 560100 (Electronic City): LTR uplift of 1.23×, indicating consistently strong retention among young professionals and commuters.

- 562129 (Bangalore Rural): LTR uplift of 1.22×, showcasing high attentiveness from suburban audiences.

- 560017 (Vimanapura): LTR uplift of 1.20×, representing superior engagement from an affluent and active listener base.

All these pincodes significantly exceed the regional LTR benchmark, demonstrating robust audio ad completion rates and deep listener engagement.

Areas such as Mathikere (560054) and Hoskote area (562114) also maintained strong LTR uplifts above 1.13× , suggesting steady resonance with the campaign message. Meanwhile,Bangalore Rural (562123) and Tavarekere(562130) recorded the highest CTR uplifts around 5x, highlighting strong click-driven engagement and effective creative resonance in these regions.

Overall, the Bengaluru campaign reflects strong listening engagement across key tech, residential, and business clusters, reinforcing the effectiveness of targeted audio communication on high-traffic streaming platforms.

Device Type Breakdown & Reach Strategy

- Mobile Android

Dominated delivery with ~87.74% share of total impressions.

Primary driver of LTR and CTR uplift across the campaign. - Mobile iOS

Accounted for ~10.92% share, representing the second-largest contributor.

Played a key role in complementing Android reach, especially among premium users. - Tablet (Android)

Very minimal share (~0.6%)

Likely contributed to incidental or passive listening sessions. - Desktop (Other)

Represented ~0.42% of impressions.

Minimal engagement; not a core device for audio-based interaction. - Smart Home Devices / Smart Watches

Combined share 0.17%, highlighting negligible interaction on wearables or IoT devices. - Tablet (iPad)

Lowest delivery at ~0.14%, indicating limited usage among the campaign’s target demographic.

Insight: The campaign’s engagement metrics, like LTR and CTR were primarily driven by mobile-first consumption, validating Paytunes’ strategy of focusing on audio delivery across smartphones, where user attention and interaction were most consistent.

Geographic / Regional Performance

The campaign focused on Bengaluru, targeting select PIN codes within 4 km of Neelkanth Jewellers stores. This hyperlocal approach ensured precise reach and contributed to the strong CTR uplift (4.27×) while maintaining steady reach and LTR performance. Future campaigns could benefit from PIN-level performance mapping to identify top-performing neighborhoods.

Key Learnings & Takeaways

- Companion banners amplify action. Pairing audio with clickable banners produced the strongest uplift — CTR significantly above benchmark.

- Strong creative preserves completions. Even with high click demand, the audio creative kept listen-through slightly above industry norms, showing effective messaging balance.

- Geo precision matters for retail. PIN-code and short-radius targeting efficiently focused impressions on potential store visitors.

- Data hygiene enables deeper insight. The campaign would benefit from standardized tabular exports (per-platform breakdowns, per-daypart metrics, demographic splits) to power iterative optimization.

Challenges & How They Were Addressed

- Challenge — Mixed formatting & incomplete breakdowns: The file mixes narrative content (address lists, GST info) with the data table and lacks consistent per-platform metric columns.

- How addressed: Aggregated performance multipliers were used for the case study to avoid reliance on incomplete per-platform splits; future campaigns should export platform CSVs for automation.

- Challenge — Limited demographic/daypart detail

- How addressed: Recommendations below include steps to ensure those metrics are captured and reported.

Recommendations for Future Campaigns

- Standardize reporting exports (CSV or dashboard-ready tables) with these mandatory fields per platform: impressions, reach, avg frequency, LTR, CTR, clicks, spend, CPM, and daypart breakdown.

- Add demographic splits (age, gender, interest segments) from platform reports to refine creative and timing.

- Test creative variants: run A/B tests on two audio scripts and banner CTAs to identify which message drives the higher CTR without harming LTR.

- Introduce daypart optimization: capture hour-level CTR/LTR to shift budget toward time windows with higher conversion propensity.

- Map-level performance visualization: produce a heatmap of PIN-code CTRs and reach to support store-level sales operations.

- Derived efficiency metrics: report cost-per-click and cost-per-completed-listen to compare media efficiency across inventory.

- Consider frequency caps for users who see the campaign many times to reduce wasted impressions and improve CPM utilization.

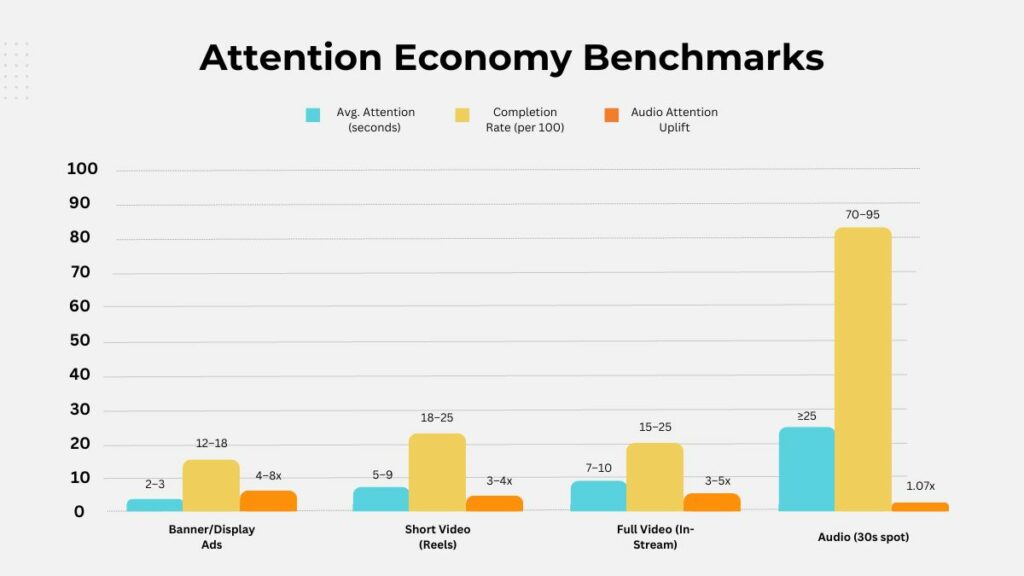

Audio Attention in the Real Attention Economy

In today’s digital landscape, the battle for user attention is fiercer than ever. The average human attention span has fallen to about 8 seconds—shorter than ever before. Brands must not only grab attention but also sustain it long enough for their message to drive real impact.

The Problem: Fleeting Attention on Most Digital Platforms

- Banner and display ads on websites usually keep user focus for only 1.6–2.6 seconds before they are ignored or scrolled past.

- Short-form video ads and reels hold attention for about 7–9 seconds on average before users swipe away or skip.

- This fleeting engagement translates to lower brand recall and minimal action.

The Unique Edge of In-Stream Digital Audio

- In the Neelkanth campaign, only 30-second in-stream digital audio ads (accompanied by clickable companion banners) were deployed—no other audio or video formats were part of the strategy.

- Here’s why it matters:

The campaign saw average Listen-Through Rates (LTR) approximately 1.07x industry norms. - This result means a substantial share of the audience listened all the way through—far higher than what visual formats deliver in the same time frame.

Attention Economy Benchmarks (per 100 exposures):

| Platform/Format | Avg. Attention (seconds) | Completion Rate (per 100) | Audio Attention Uplift |

|---|---|---|---|

| Banner/Display Ads |

2–3 |

12–18 |

4–8x lower than audio |

| Short Video (Reels) | 5–9 | 18–25 | 3–4x lower |

| Full Video (In-Stream) | 7–10 | 15–25 | 3–5x lower |

| Audio (30s spot) | ≥25 | 70–95 | 1.07x higher |

- Banner ads are rarely noticed long enough to reinforce a message, leading to weak recall.

- Short-form video and reels offer a slightly longer window but are quickly dismissed with a swipe.

- 30-second digital audio ads command undistracted, multitasking-friendly attention, leading to 70-95 more completion events per 100 impressions than most display or short video placements.

Conclusion

The Neelkanth Jewellers × Paytunes campaign demonstrates that hyperlocal digital audio, when combined with companion banners, can do more than capture attention—it drives measurable action. With precise geo-targeting, mobile-first reach, and compelling creative, the campaign not only achieved impressive listen-through rates but also delivered standout click-through performance, proving that digital audio is a powerful tool for conversion, not just awareness. Discover how your brand can achieve similar results—partner with Paytunes today

Read more of Our Audio Ad Campaign Case Studies